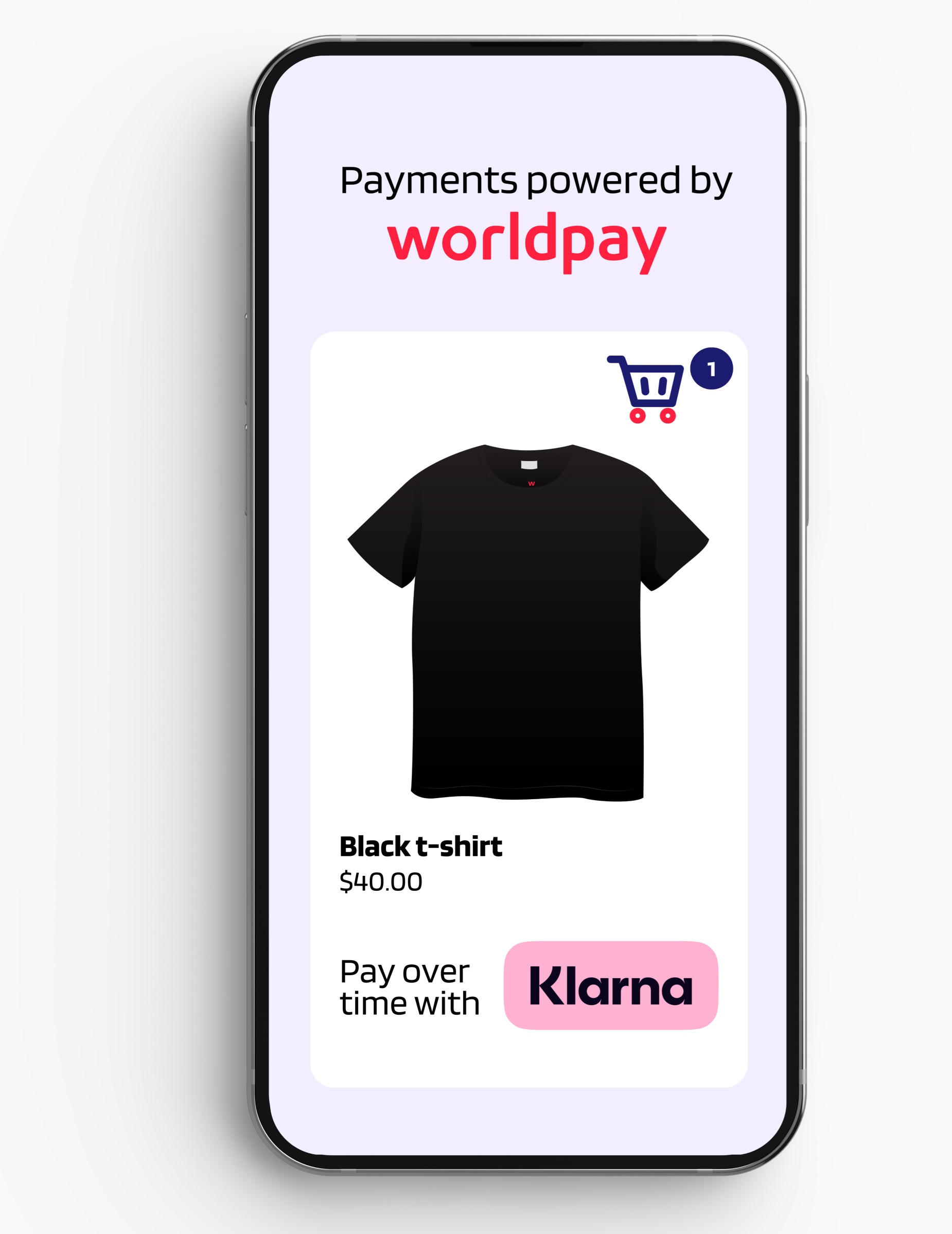

Klarna becomes a default payment solution with Worldpay

The Swedish BNPL giant continues to expand. Klarna can now count on the support of Worldpay, a payment service provider (PSP) operating its services worldwide. Klarna's payment services will be offered as the default payment method by Worldpay to its merchants worldwide.

FACTS

- Klarna has therefore just announced that it has extended its partnership with Worldpay to enable thousands of new merchants worldwide to effortlessly offer Klarna services to their end customers.

- Klarna becomes a default payment option, alongside traditional card payments.

- The BNPL giant will offer various payment solutions:

- immediate payments,

- short-term interest-free deferred payments,

- longer-term financing.

CHALLENGES

- Capitalizing on a dynamic offering: In its annual report on global payments, Worldpay highlights very positive forecasts for the deployment of offerings such as Klarna. It estimates that digital wallets like Klarna will grow by 15% a year until 2027. The two partners also point out that a third of the transactions processed by Klarna involve immediate card payments or direct account-to-account payments.

- Access to a global network of merchants : Worldpay boasts one of the world's largest payment service providers, processing $2.3 trillion in transactions per year (by 2023), for over a million merchants worldwide.

- Extending an existing partnership: this is not the first time Klarna and Worldpay have collaborated, but they have been working together for years now. Back in 2017, the two partners joined forces to offer invoice and spread payment services to businesses in Austria, Finland, Germany, the Netherlands, Norway, Sweden and the UK.

MARKET PERSPECTIVE

- While Affim has just set up shop in the UK, marking its arrival on the European market, Klarna is also continuing its roll-out.

- In addition to its global positioning, now supported by Worldpay, Klarna recently launched a BNPL-based gift card service. At the beginning of October, the BNPL specialist strengthened its partnership with Adyen to expand into the physical retail sector, and at the end of September, it joined forces with Xero to offer BNPL to SMEs.

- In August, Klarna even sought to copy the banking market, once again demonstrating its dynamism.