Visa Flexible Credential arrives in the U.S.

While the solution was presented as a flagship innovation by the American scheme last May, Visa Flexible Credential has finally lived up to its ambitions by announcing its international roll-out, particularly in the USA. This roll-out is ensured by a local partnership signed with Affirm for the BNPL component of the offering, further extending Visa's all-out positioning in the payment market.

FACTS

-

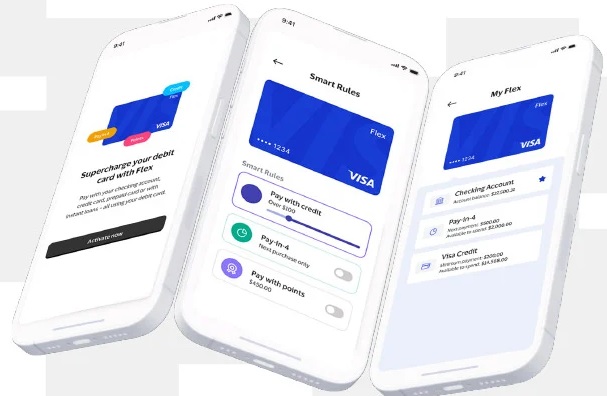

Visa Flexible Credential was presented last May as a major innovation aimed at transforming a Visa payment card into a credential enabling seamless access to other sources of supply, instead of just the account attached to the card.

-

Among the possible supply accounts, the solution allows you to draw money from current accounts, loyalty accounts, prepaid or even instalment payments.

-

On this last point, the launch of Visa Flexible Credential in the USA is based on a partnership signed between the scheme and local specialist Affirm. Visa Flexible Credential will be deployed on the Affirm Card, a debit card enabling users to “buy now and pay later”, via the Affirm service.

-

Already operational in several pilot markets, notably in Asia, the American scheme will now be able to offer its solution in the United States.

-

The United Arab Emirates are also involved in this new deployment phase, via a partnership signed between Visa and Liv, a leading local digital bank.

-

Visa Flexible Credential will then be progressively internationalized in other regions of the world, an appropriate move insofar as Visa Flexible Credential also enables users to pay in different currencies. This feature will be available to Liv customers in particular, and will support five currencies: the US dollar, the British pound, the euro, the Canadian dollar and the Australian dollar.

CHALLENGES

-

A far-reaching partnership: The merger of Visa and Affirm represents a major move in the payment market, bringing together a global reference in payment and a leader in BNPL. Their collaboration now enables American users of their joint offering to pay at their convenience, combining Visa's payment technology with Affirm's fractional payment services. Visa and Affirm also began working together on this theme last July, when they announced the signature of a new strategic partnership with Marqeta to ensure the deployment of Visa Flexible Credential.

-

Capitalize on a tool that's already well deployed: The Affirm Card is currently used by over 1.4 million consumers in the United States.

-

Confirming the relevance of an offering and wider ambitions: Visa points out that in Japan, for example, where it offers its product through a partnership with Sumitomo Mitsui Card Company, Limited (SMCC), over 3 million Olive account holders benefit from Visa Flexible Credential. Visa and SMCC have also adapted their joint offering to meet the specific needs of small businesses, opening up Visa Flexible Credential to a new target group. The current test should lead to the roll-out of the professional offer to other markets.

MARKET PERSPECTIVE

- Visa is currently focusing on an accelerated diversification strategy. Biometrics, fraud prevention and management , cryptoactives and cross-border payments are all sectors in which Visa is particularly interested.

- In addition, Visa is more broadly involved in the democratization of BNPL solutions and a cross-border payment solution, including, in time, for professionals, pushing even further the multimodal nature of its payment offering.