Finfrog, from microcredit to fragmented payments

A new entrant in the highly sought-after fragmented payment segment. It is the fintech Finfrog born in 2016 and specialized in micro-credit between individuals. It is now targeting e-retailers, marketplaces and other merchants. According to its founder, this pivot is explained by the inclusive nature of fragmented payments.

FACTS

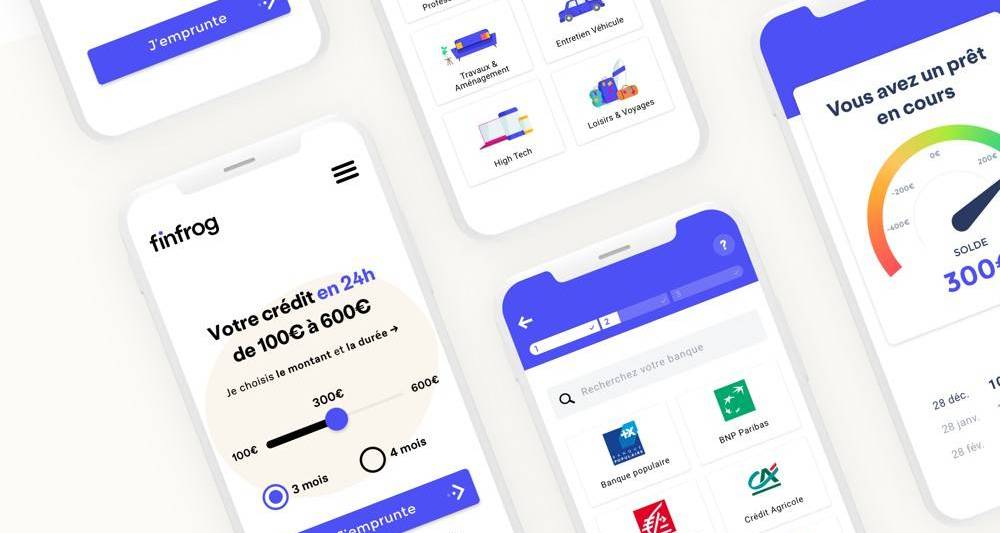

- A French startup founded in 2016, Finfrog lends to people who are creditworthy but excluded from traditional credit channels.

- More than 150,000 customers have used its services since its launch.

- With this solution, Finfrog is targeting more merchants and e-merchants who have been growing rapidly over the past two years. This solution will allow them to increase their conversion rate and the number of average baskets by allowing the purchase in several times.

- The start-up will offer payment in 10 or 12 instalments for baskets ranging from 50 to 5,000 euros.

CHALLENGES

- Enhance its expertise to grow: Finfrog relies on a scoring method developed internally and proven by five years of activity.

- Develop its offer to its target: Finfrog, which already offers repayments over 24 months for some of its partners, should offer this more widely. Amounts and durations are calibrated on a case-by-case basis.

MARKET PERSPECTIVE

- In general, split and deferred payments are the big trend in the fintech world. The American PayPal and the Swedish Klarna, which recently launched its offer in France, are the best known players.

- On the French side, Alma has recently partnered with Banque Postale Consumer Finance to finance merchants' receivables.

- Younited, the consumer credit specialist, will strengthen its deferred payment offer for merchants thanks to its latest fundraising.