BoursoBank opens to cryptoactive trading

BoursoBank has just announced the enrichment of its stock exchange offering allowing its customers to make investments via an Ordinary Securities Account (CTO), an Equity Savings Plan (PEA) or a PEA-SME. From now on, investors will also be able to choose to place their money on cryptoactives via an exchange trading notes selection with underlying cryptoactives offered on the stock exchange.

FACTS

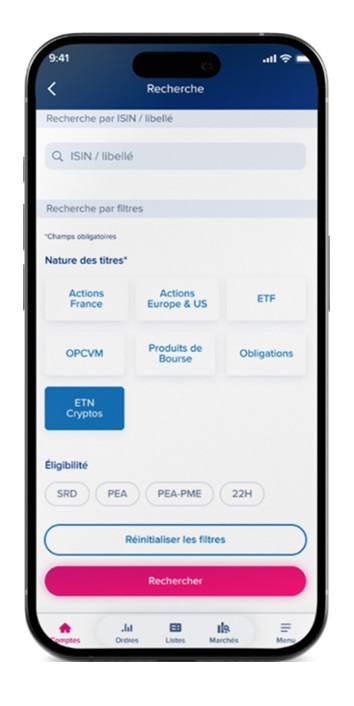

- The 7.2 million BoursoBank customers will now be able to access a new cryptoactive investment service directly within their mobile banking application.

- BoursoBank offers, via its dedicated Stock Exchange offer, the possibility to invest in a selection of the Exchange Traded Notes issued by iShares (a BlackRock brand) and CoinShares, with cryptoactive underlyings.

- BoursoBank allows its clients using Stock Exchange to now invest in crypto-backed financial instruments such as Bitcoin, Ethereum, XRP, Solana and Cardano.

- BoursoBank promises an offer and a new service accessible, easy to use and ensuring a high level of protection against the risks of fraud.

ISSUES

- Meeting new expectations: According to the figures highlighted by BoursoBank and taken from the AMF risk mapping and markets Last June, 9% of French people currently hold cryptoactives. The latter are even the most frequently held financial product by new investors, 54% of them.

- Follow his group's strategy BoursoBank is a subsidiary of Société Générale operating under its own brand, with a 100% online model. Societe Generale has already positioned itself on the cryptoactive market via its other specialized subsidiary, Forge. The deployment of its own crypto trading service today represents a new step in the group's overall strategy on the theme.

- Monitoring the momentum of competition BoursoBank is now catching up with competition already well engaged in the democratisation of cryptoactives and crypto trading in France. Revolut Opened thus more widely decentralized finance in 2022 after launching its own crypto trading offer in 2017. The service is now also accessible to the French clients of the neo-bank which has also confirmed its growing ambition for this market by presenting Revolut X, an application dedicated to professional crypto traders. For his part, N26 proposed N26 Crypto in France in 2024 after launching service in Austria in 2022. Lydia Attacked for its share in the French cryptoactive trading market in 2021.

PERSPECTIVE

- The launch of this new service by BoursoBank is a way for the online bank to complete its service offering and satisfy its customers.

- Recognized as bleast expensive anque for the 17th consecutive year, according to investigation by Le Monde and Panorabanks at the end of 2024, BoursoBank remains particularly attractive on the market. To the point that it was able to win 1.52 million new customers by 2024 alone, getting a little closer to its goal of relying on a portfolio of 8 million accounts by the end of 2025. Another figure very close to 9 million customers Served in France today by BoursoBank's parent company, Société Générale.

Traduit automatiquement via Libretranslate / Automatically translated via Libretranslate