Westpac launches emergency service to block hacked accounts

New banking initiative to combat payment-related fraud with Australian bank Westpac who chooses to respond to the urgency that this type of situation can represent through simple functionality. Its new service called SafeBlock carries the promise of optimal responsiveness.

FACTS

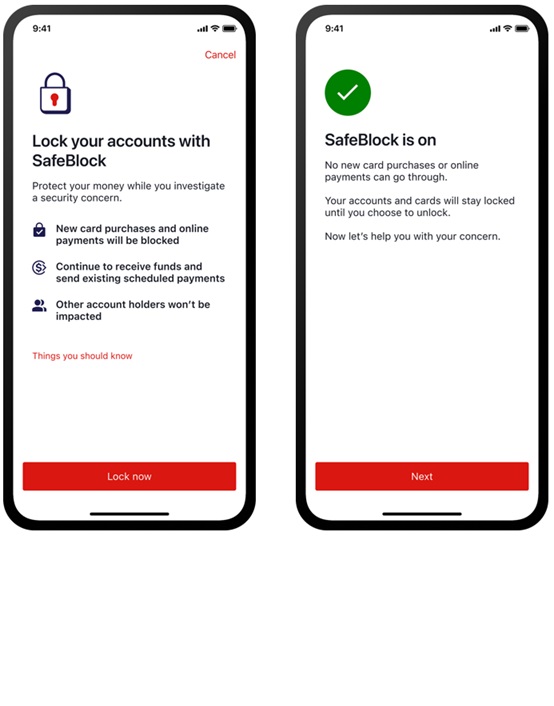

- So Westpac has just introduced its new initiative called SafeBlock, taking the form of a feature allowing customers to instantly block and unblock their account via their mobile banking app and in just a few clicks.

- The SafeBlock activation is presented as ultra-simplified to allow Westpac customers to instantly block new transactions, including digital and card payments, transfers and withdrawals to vending machines.

- Preprogrammed transfers and subscriptions will not be affected by the blockage.

- Customers will also be able to disable SafeBlock just as simply as at the time of activation, once the security of their accounts is verified.

- The functionality will be available to customers in the coming months via the Westpac app and its online banking services.

ISSUES

- Responding to the emergency : SafeBlock aims to provide greater control over account security for bank customers, thanks to a functionality that can, through its ease of use, help them react urgently to a situation or suspicion of fraud that necessarily requires a great deal of reactivity.

- Post-prevention Westpac states that it has invested more than $100 million in fraud prevention over the past two years, thus allowing its customers to avoid more than $400 million in losses. A fundamental trend is currently driving many financial and banking actors to enrich their discourse and actions in the area of prevention and pedagogy to help clients better protect themselves against the risks of fraud. But here, the goal is not to raise awareness among clients to help them prevent risk, but to help them react as quickly as possible when the risk is nevertheless realized.

PERSPECTIVE

- Westpac's new initiative is a way to further improve the anti-fraud tools placed in the hands of its clients. It follows a model that had already been initiated in the past by some competing players in the bank.

- OCBC, for example, demonstrated this in 2022 by presenting its "Kill switch"This is also supposed to quickly and completely block the accounts of its clients who are victims of fraud to limit the damage. Singaporean bank presented digital locks later named Money Lock, to allow its customers to block only part of the amounts in their accounts in order to make them inaccessible to any attempt at undue transfers.

- Most banking and financial players also offer more or less enriched card blocking features, such as those presented in Australia by Westpac's main competitors. For example, the Commonwealth Bank of Australia launched in 2014 "Lock, Block and Limit", proposed to lock down means of payment or certain transactions. ANZ carries for its part "Card Control"

Traduit automatiquement via Libretranslate / Automatically translated via Libretranslate