Subscribing a Travel Insurance via Facebook Messenger

FACTS

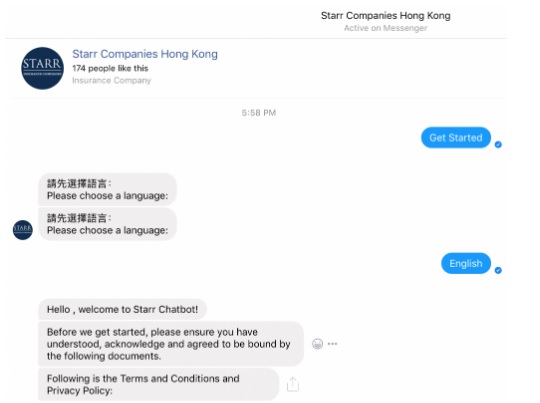

- Starr Insurance adds a Facebook Messenger chatbot for their travel insurance.

- This AI-powered Machine Learning-based chatbot allows customers to interact using natural language.

- Goals: this bot is first meant to let Internet users apply for travel insurance offers, and be sent answers to simple questions.

- Customer process: for starters, this chatbot asks a series of questions to customise the insurance plan (yearly insurance or for a single trip, coverage levels, travel dates, etc.). The users may then provide their personal information and pay for their insurance by card. The contract is automatically sent via e-mail.

- Despite its ability to rely on natural language, this bot only relies on guided discussions (button-based check lists). The conversation may go back and forth.

- This bot may later be able to deal with other services, including processing claims and damage reports, for instance.

CHALLENGES

- Shorter subscription processes. Starr intends to save their customers and prospects time when applying for a travel insurance: an easy-to-subscribe product even at the last minute.

- Aiming for young customers. Starr Insurance opts for Facebook Messenger to potentially aim for younger customers and bets on social media to handle customers’ requests on-to-go.

MARKET PERSPECTIVE

- Other travel insurance players already implemented similar channels. FWD Singapour or AXA rely on WeChat-based chatbots for their application processes as well as for claims.

- Zurich, for its part, opted for a relatively similar approach with Pluto in the UK: building on mobile connectivity and social media for near-instant travel insurance subscriptions. In this case, Facebook Messenger plays e part in dealing with customer relation and claims.