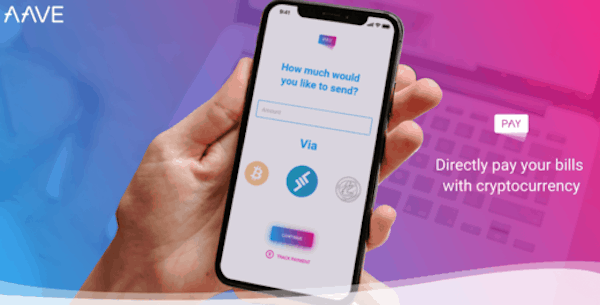

Aave Unveils a Crypto Asset-Based Bank Transfer Option

FACTS

- The British FinTech –subsidiary of ETHLend– launches a mobile app enabling its users to pay everyday bills in virtual currencies.

- Goal: free crypto-assets’ potential and increase their popularity

- The app called Aave Pay may be used by individual people (P2P money transfer) or by corporate customers (payrolls, income taxes, corporate or commercial expenses, etc.).

- How it works. To carry out a transfer, the customer must

- Opens the app and pick the cryptocurrency he wants to use

- Specify the amount in fiat currency (EUR, USD, CHF, GPD, AUD, INR)

- Provide the recipient’s IBAN

- Aave Pay calculates an attractive exchange rate and specifies the overall transaction cost

- Aave Pay automatically processes the payment, sending the amount to the beneficiary’s bank account

- Featured crypto-assets:

CHALLENGES

- Ensuring cryptocurrencies mainstream adoption. Aave takes the concept one step further for crypto-asset holders. They claim they want to break “the paradigm that cryptocurrencies are only asset people invest in and cannot be used as traditional currencies”.

- Aiming for more customers. The British Fintech bets on cryptocurrencies, which are still coveted by young connected customers. They target a new audience, interested in these assets but discouraged by their costs as well as by some platforms’ intricacy.

MARKET PERSPECTIVE

- A month ago, Aave was granted two licences from the Estonian Financial Intelligence Unit. They may then expand their range of services in Europe, including with Aave Pay.

- Just like this start-up, several other companies are focusing on crypto-assets derived opportunities. Facebook would consider letting their users rely on a cryptocurrency to send money or pay for some services.