Apple to reinvent credit card with savings

The American tech company has long been committed to diversifying its activities, including in the financial services market. Its efforts have even been strengthened in recent months with the launch of a dedicated entity. The brand new product launched by Apple is a saving account that aims to reinvent the credit card fundamentals.

FACTS

-

The Apple Card will soon allow its users to build up savings in an affiliated account with Goldman Sachs bank.

-

The service is linked to the Apple Card's Daily Cash feature. It takes the form of impulse savings, enabling the cashback to be invested automatically in a dedicated account.

-

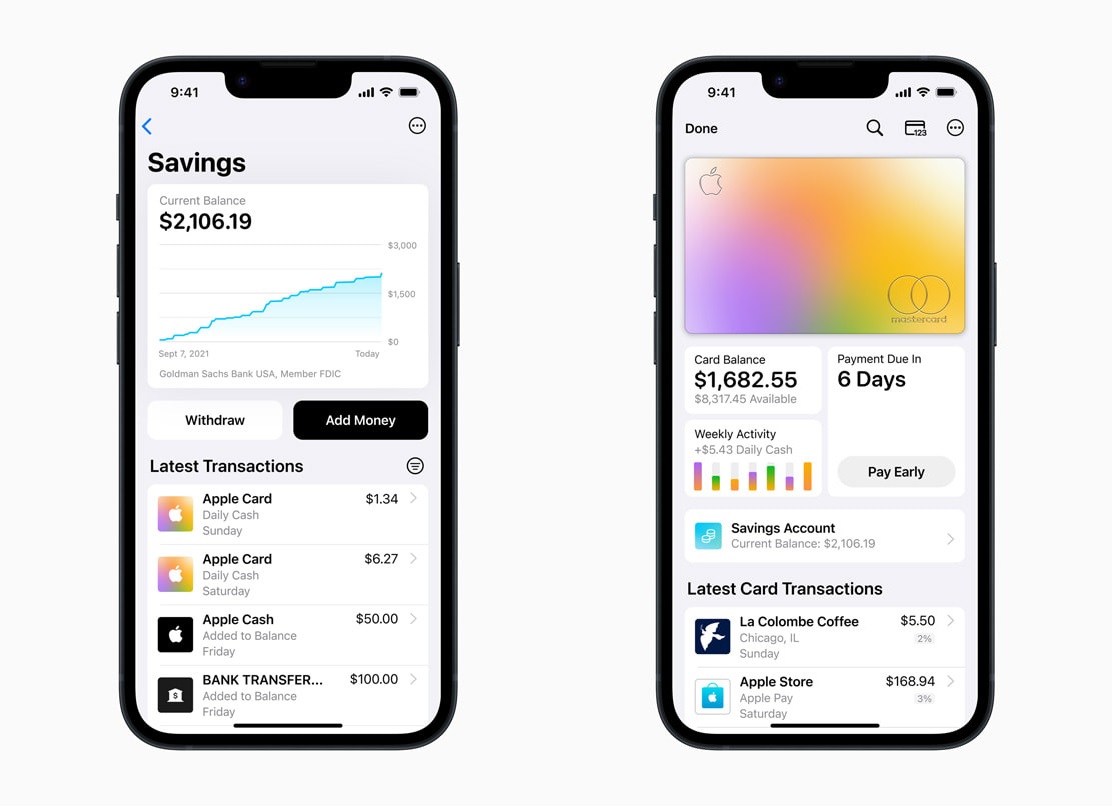

The service is monitored from the Apple Wallet hosting the attached Apple Card:

-

configuration of the savings account,

-

management and tracking of savings,

-

automation of deposits,

-

change cashback allocation at any time (savings account or Apple Card),

-

view savings from a dashboard.

-

-

Additional funds can also be deposited into the Goldman Sachs account from another bank account or directly via the Apple Card.

-

Without providing further details, Apple and GS state that this savings account will be subject to a higher interest rate than the market standard. There is no minimum balance, deposit or withdrawal amount.

CHALLENGES

-

Consolidate its financial positioning: Apple has just made its mark on the market in the area of mobile payments, as the use of Apple Pay is growing. The legitimacy of its positioning on the financial market is therefore acted, and today it is naturally open to offering new services via its Apple Financing dedicated branch and its partnerships with GS, in particular.

-

Improving the financial health of its customers: Presented three years ago as a UFO in the credit cards world, the Apple Card's ambition was to help its customers pay as little interest as possible, by playing on the debit/credit slider and helping them to repay the amounts incurred before they generate any fees. Apple goes even further down the "financial health" spectrum by boosting their savings efforts through automation.

-

Going public: For Goldman Sachs, the tie-up with Apple is another way to serve the retail market. The investment bank has been relying on the deployment of its dedicated offering, Marcus, for this purpose, but the latter seems to be experiencing difficulties according to some market observers.

MARKET PERSPECTIVE

-

The credit card model has been widely criticised in the US as generating significant costs for consumers. Even if their market share is maintained among a part of the clientele, younger people are increasingly turning away from these means of payment and prefer alternative payments such as the BNPL.

- The automation of savings is a very popular service for customers, that has popularized Personal Financial Management apps, such as the American neobank Chime or the fintech Clarity, which had been taken over by Goldman Sachs, that is partnering with Apple to produce the Apple card.