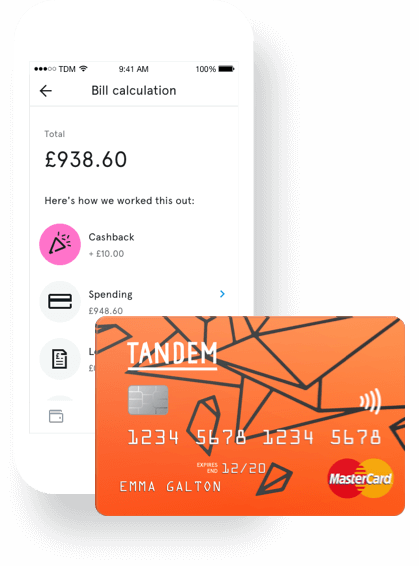

A Credit Card with Cashback Feature for Tandem

Just a few months after they bought out Harrods stores’ banking subsidiary, along with their banking licence, the full-mobile British neo-bank unveils their first product: a Mastercard-affiliated credit card, which comes with a cashback feature, and does not apply fees spending abroad.

This card is paired with a PMF service enabling customers to link their bank accounts and credit cards to the app. The idea is to provide their cardholders with the possibility to check their transactions in real time.

Tandem Bank relies on a cashback feature by way of convincing customers to adopt this credit card (18.9% APR). This cashback amounts to 0.5% on each purchase they make, with no limit applied.

Eventually, this credit card does not apply fees when spending abroad.

Comments – Neo-banking players’ success confirmed

In order for them to become viable alternatives to traditional banking players, FinTechs and neo-banks keep expanding their ranges of products and services. In the UK, the neo-bank ecosystem is flourishing: just like Tandem Bank, several players –including many with a banking licence– are already positioned. Monzo, for instance, had unveiled a mobile app, along with an international card (with systematic authorisation). Revolut, for its part, proposes a free bank card, and Starling Bank allows its customers to subscribe a credit card right from their mobile app, in a matter of minutes.

Unlike other challengers, Tandem Bank chose to acquire a company which had already been granted a banking licence. This credit card will be their first commercial launch, i.e.: a fairly common product in retailers’ sets of offers, including Harrods’ offers. This service is, however, enhanced through combining a no-fee approach for transactions conducted abroad and a cashback feature (which is seldom the case with credit cards). Also, the PFM app (based on Personetics’ AI technology) provides this card with a credit management tool. With Harrods Bank’s banking licence, this FinTech should soon be proposing savings deposit accounts, as well. This choice could make things more difficult for this neo-bank, since Harrods Bank’s existing customers will have to be included and the overall offer will need to be unified. In France, the closest example could be Orange Bank, based on the buyout of Groupama Banque.