Younited Credit publishes a study on instalment payments

For several years now, the use of fractional payments has been a must for European merchants and consumers. In this new study, Younited takes a look at how the French and Spanish markets are evolving, and at the use of fractional payment methods in relation to 2021. Convenience is the main selling point, ahead of free payment in France and Spain.

FACTS

-

The French prefer to pay in instalments for larger average baskets. Among the major emerging trends, fractional payments over short periods have lost ground:

-

Consumers having made at least one purchase over €200 made less use of fractional payment (2 to 4 times) in 2023 (-16 points compared to 2021).

-

+ 6 points for average baskets between €1,000 and €3,000

-

+ 9 points for repayment terms of 5 to 12 months, also present on the Spanish market:

-

29% of purchases are paid for in 13 months or more (up 14 points).

-

Only a third of Spanish consumers surveyed paid in two to four instalments (down 10 points), compared with two-thirds in France.

-

-

Nearly half of French (45%) and Spanish (49%) consumers have used this payment method for purchases over €1,000.

-

-

Fractional payments are entering the luxury market and are popular in stores:

-

In France, 3% of consumers have used split payments to buy a luxury product in the last 6 months.

-

This figure could rise to 6% in the next 6 months, 12% in the long term and up to 19% in Spain.

-

In France, +17 points for purchases in physical stores, representing 52% of transactions.

-

- 14 points for online purchases with home delivery, down from 51% to 37% in 2023.

-

-

A loyalty-building tool:

-

78% of French consumers and 86% of Spanish consumers say it will encourage them to return to the store or website where they made their first purchase.

-

Convenience is preferred by 45% of French and 33% of Spanish consumers:

-

Free shopping for 39% and 29% of them, down 9 points in France and 18 points in Spain.

-

-

A solution for preserving purchasing power in times of high prices:

-

for 30% of French respondents, "paying cash will make it harder for them at the end of the month".

-

40% of consumers will have to pay in instalments when making purchases, whereas they used to pay cash, due to inflation.

-

CHALLENGES

-

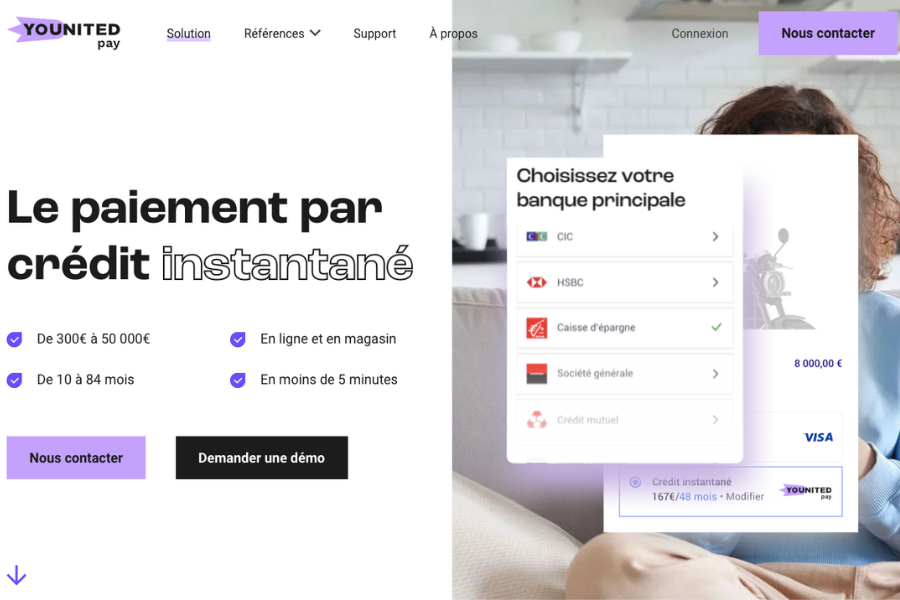

Larger amounts and longer repayment periods: since 2021, fractional payments have been used for increasingly larger amounts. Younited, for its part, has positioned itself with an offer starting from 300 euros for repayments in 10 instalments. As a result of this trend, fractional payments are increasingly used in the luxury goods sector, where average shopping baskets are higher. What's more, it's the convenience of fractional payment that is the main argument for its use, ahead of the fact that it's free.

-

A return to favor at physical points of sale: fractional payment is also increasingly used at the point of sale, whereas its emergence had been favored by the boom in e-commerce.

MARKET PERSPECTIVE

-

According to Kaleido Intelligence, the global fractional payment market could triple by 2025, reaching $250 billion.

-

Franfinance has announced the launch of Franfipay, a range of 100% online financing solutions available to consumers via Franfinance partner merchant sites. This move by the Société Générale subsidiary is part of a gradual shift towards larger amounts. The company is extending the range of online credit options, opening up the financing of goods up to 30,000 euros.

-

This announcement also follows the new BNPL offer announced by Sofinco with Decathlon to propose a fractional payment offer, enabling end customers to pay for their purchases in an extremely simple way.