Visa wants to make MBDCs interoperable

Payment giant Visa has just revealed the new outline of its ambitions for Central Bank Digital Currencies. In order to become a reference in this future market, Visa is now planning to take charge of the interoperability of these crypto-currencies.

FACTS

-

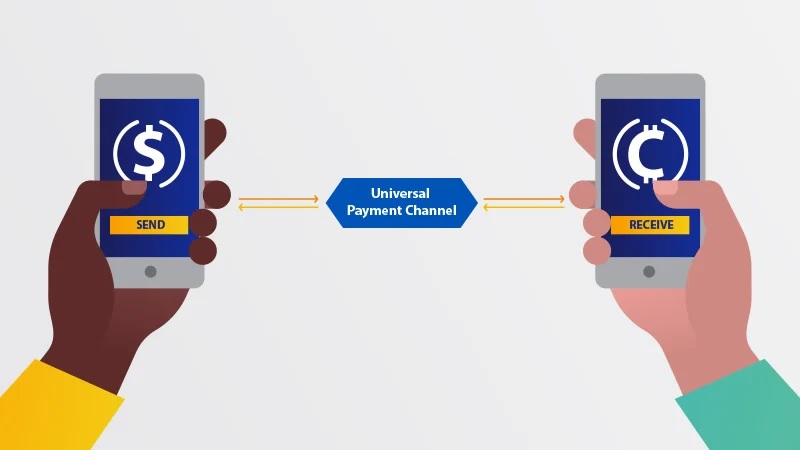

Visa has just unveiled a concept developed by its teams and called "Universal Payment Channel" (UPC). As its name suggests, its ambition is to create gateways between Central Banks' Digital Currencies, in order to promote channel interoperability.

-

Visa teams have been working on UPC since 2018. This work has finally resulted in the emergence of a universal payment channel capable of connecting the networks of stable digital currencies and the blockchains of central banks and private players.

-

For governments are not the only ones targeted by the UPC service, which is committed to serving all digital currencies, including stable private or counting among the leading crypto-assets (Bitcoin and Ethereum in the lead).

-

This service, in the form of a hub, will thus promote secure exchanges between digital currencies. Visa presents UPC as a universal blockchain adapter.

CHALLENGES

-

Participate in the democratization of CBMs: Facilitating exchanges between CBMs has been at the heart of Visa's work for many months. The payment giant is indeed looking to move from its "only" status of scheme to that of reference of this future economy relying on stable digital currencies. Visa had already launched an offline MNBC exchange solution in December 2020.

-

Entering the international transfer market: What Visa has in mind seems to be a payment solution similar to what RippleLabs has been offering for several years. The latter relies on the XRP exchange market to move funds across borders between two accounts held in different currencies.

MARKET PERSPECTIVE

-

Yuan, Crown, Rupee, Euro, Dollar, ... Many national currencies are now working on their transformation to a digital version. Dematerialized exchanges are becoming more and more important, underlining the legitimacy of these new currency models.

-

Visa is not only interested in MNBCs but in all crypto-currencies. The group is posing as a partner of financial organizations in general on this market by also offering since last February APIs allowing banks to offer their customers to buy, hold and sell crypto-currencies.

-

The company regularly reaffirms its commitment to developing its crypto offering. In 2020, by partnering with Circle, VISA had announced support for USDC stablecoin on select credit cards. The payments giant was also making a big splash this summer, buying its first CryptoPunk for $165,000.