Visa sets itself up as an expert on crypto-currencies

Payment giant Visa has introduced a brand new crypto advisory service. Aimed at its partners, it should enable Visa to establish itself as a reference in a booming market and guarantee the Visa brand's status as a payment giant, well beyond the card.

FACTS

-

Visa has announced the launch of the Global Crypto Advisory Practice, a new offering from Visa Consulting & Analytics (VCA). It has been designed entirely as a service to support Visa's clients and partners in their use of crypto-currencies.

-

The target audience for this offering is broad:

-

Financial institutions looking to attract or retain customers with a crypto offering,

-

merchants looking to dive into NFTs,

-

central banks positioning themselves on digital currencies.

-

-

"Global Crypto Advisory Practice" shall help Visa partners to:

-

better understand the crypto ecosystem,

-

assess the crypto-currency market opportunity,

-

develop concrete strategies,

-

launch pilot programs related to new user experiences.

-

-

In doing so, Visa is leveraging its expertise based on the collaborative work of its global network of consultants with more than 60 crypto-currency specialist platforms.

CHALLENGES

-

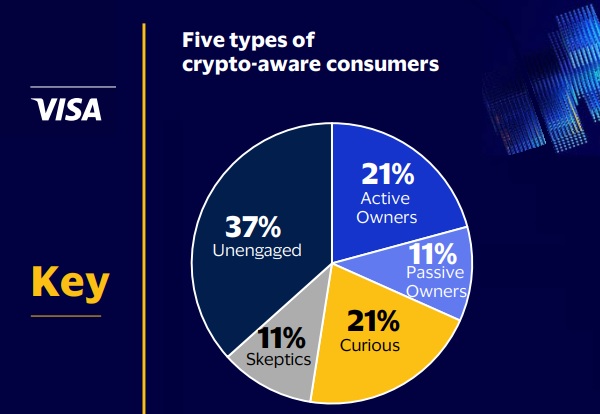

Supporting awareness: The crypto-currency market is becoming more concrete every day and is prompting financial institutions to position themselves. To launch its new advisory service, Visa is also relying on its global study revealing that nearly 40% of crypto-currency users would be likely to switch their main bank to an institution offering crypto-currency services.

-

Completing a system under construction: The launch of its advisory service would allow Visa to enrich its offer of support for financial organisations in the crypto-currency market. In February, Visa presented APIs that allow banks to offer their clients the ability to buy, hold and sell crypto-currencies.

KEY FIGURES

Visa's "The Crypto Phenomenon: Consumer Attitudes & Usage" study found that :

94% of households are aware of crypto-currencies

37% of consumers aware of crypto-currencies in emerging markets use or own crypto-currencies, compared to 29% in developed markets

Of current crypto-currency holders, 81% say they are interested in crypto-related payment cards

MARKET PERSPECTIVE

-

Visa's interest in crypto-currencies is not new. As a payment giant, Visa has been involved in this market for several months now in order to avoid its potential disruption.

-

Last October, this strategy prompted Visa to reveal grand ambitions to make MNBCs interoperable. With the multiplication of initiatives to digitise national currencies (Yuan, Crown, Rupee, Euro, Dollar, ...), Visa has sensed that a market of the future is indeed opening up. And the group is seeking to capitalise on its strike force to impose itself.

-

Its upstream positioning is all the more crucial as, beyond the new players specialising in the theme, Visa will still have to fight hard to face its eternal rival: MasterCard. The other Scheme with international reach has also entered the crypto-currency battle head-on, with initiatives of varying scope.