Lydia becomes a new French Unicorn

Lydia is back in the news, shortly after launching its trading business to further diversify. The FinTech, which had previously raised 112million from Accel and Tencent, has announced a new round of funding that allows it to reach Unicorn status. This will give a new dimension to its ambitions.

FACTS

-

Lydia has just raised over $103 million. This investment allows the company to reach a valuation of more than one billion dollars and to enter the closed circle of French unicorns.

-

Lydia's investors are participating in this new round of financing (Accel, Founders Future and Tencent). They are joined by two American investors: Dragoneer and Echo Street, although their investment amounts remain marginal.

-

With 5.5 million users (including 2.2 million French customers), Lydia has established itself as a major FinTech player in France and Europe.

-

With this new round of financing, Lydia plans to :

-

reach 10 million customers in Europe by 2025, and attempt to become their main bank account

-

hire more than 150 new employees in 2022, and 800 in total over the next three years

-

continue to develop its credit and investment services.

-

ISSUES

-

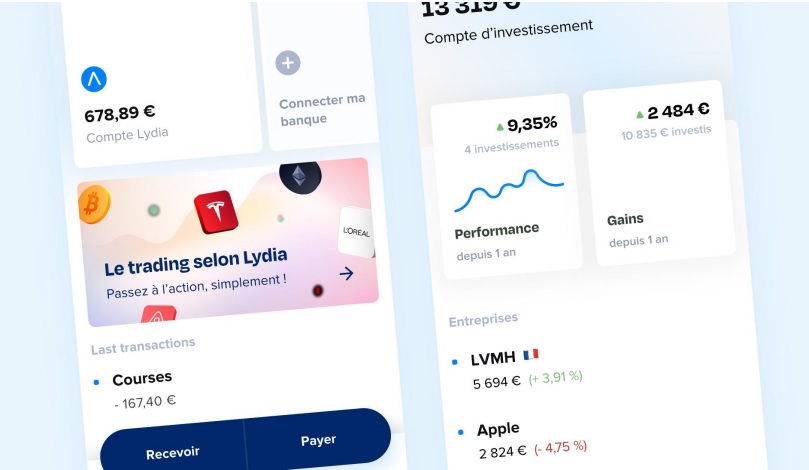

I'll make you a Lydia: This famous little phrase posted by the President of the Republic on his Linkedin account, testifies to the recognition that the fintech has been able to build, by surfing on the strong development of payment between individuals. This functionality, which it offers free of charge to its customers, costs it for each transaction. The fintech quickly diversified its offer: microcredit, savings, bank card with current account and more recently trading (shares, ETFs, crypto-currencies and precious metals) to make its business model viable.

-

Efforts to monetise its offer: The FinTech has notably carried out advertising campaigns in the metro to communicate on its offers (current, joint and savings accounts). For several months, it has also been communicating with its users about its various offers via notifications within the application.

-

Competing with neobanks and diversifying towards a super-app model: With this range of services that the fintech has set up in partnership with other fintechs such as Bitpanda for trading or Floa for microcredit, Lydia is now competing with neobanks like N26 and Revolut. It wants to further develop its offer in financial services and in particular home loans. But its ambitions do not stop there and neither do its diversification prospects.

MARKET PERSPECTIVE

-

Lydia's services attract 150,000 new users per month and cover the financial needs of a third of 18-35 year olds in France. The FinTech has also opened 2 million current accounts since the service was launched in 2018.

-

It handles €5 billion worth of transactions per year in France, Spain and Portugal, where it operates. Germany, the UK and Italy remain target territories.

-

Although Lydia does not present its turnover, it draws its income from subscriptions to its current account offer and is counting on trading to become a profitable activity in the future.

-

Lydia now intends to establish itself as a full-fledged competitor to well-known neo-banks such as Revolut (and its nearly 16 million customers) or N26 (which had 7 million customers at the beginning of the year).