Virtual POS: Afone Paiement Expands their Offers

Afone was the first mobile carrier to be granted a Payment Institution approval back in 2011, so they could provide card acquiring services. They are enhancing their services, via their subsidiary Afone Paiement, and launching a new smartphone and tablet-based POS terminal.

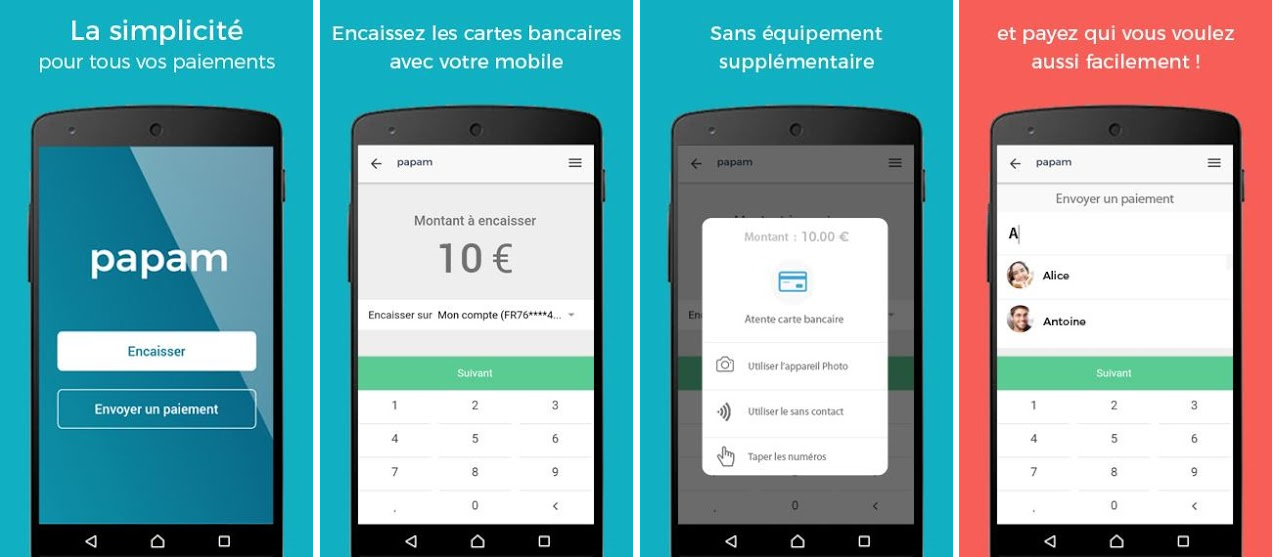

This solution called Papam relies on a commitment-free / subscription-free mobile app and does not require additional equipment. It is mostly intended for mobile businesses, including cab drivers, travelling salesmen, or GPs on home visits.

These entrepreneurs may download the app and provide their banking information so their account can be credited. Payment checkouts are processed in less than 15 seconds via card scans, manually entering their data, or contactless tap. The bill is sent automatically by e-mail or text message, and the amount is transferred within 48 hours. Papam charges a one-time 1.8% fee per transaction. A 20 cents fixed cost is also charged for transactions below €10.

The app does not imply charges to start with, and also allows users to send refunds to their customers via e-mail or text-based transfer.

Comments – POS devices becoming affordable

Several banks and FinTechs have been paying attention to the needs of nomadic businesses, via developing mPOS solutions or reducing commissions. They aim for a market likely to include more 800,000 businesses in France. By way of getting hold of this emerging market and stand out before competition, Afone interestingly bets on a virtual POS which does not require extra equipment or subscription.

Besides payment checkout, Papam also allows businesses to manage and centralise their payments using a dedicated dashboard. It also helps allows them to pay their bills or carry out SEPA Credit Transfers. Afone features an affordable 2-in-1 solution with further stresses customer relation while still ensuring quality financial exchanges.