The Bank of France notes an increase in over-indebtedness

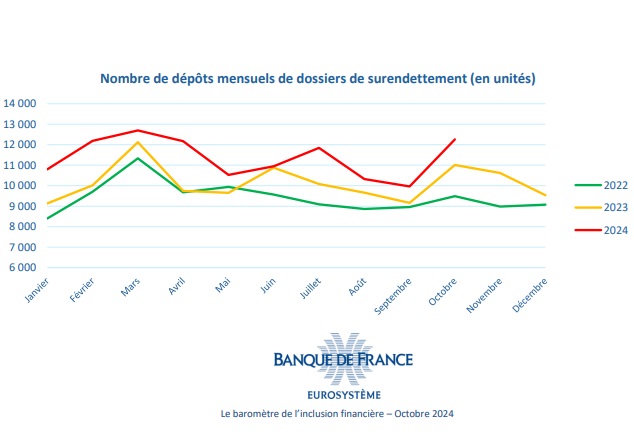

As usual Bank of France published its monthly financial inclusion barometer. On this occasion, it returned to the number of over-indebtedness cases filed since the beginning of 2024. Compared to 2023 and since January, all figures show growth in over-indebtedness in France.

FACTS

- The latest monthly barometer of financial inclusion published by the Banque de France highlights the fact that the number of over-indebtedness cases filed in October 2024 was 11% higher than in October 2023.

- Since the beginning of the year 2024 a 12% increase has been observed in the number of over-indebtedness filings, compared to the same period in 2023.

- The National Personal Credit Reimbursement Incident File (PCIF) recorded an increase in the number of new registrations of individuals by 3.7% over the first 10 months of 2024, compared to the same period in 2023.

ISSUES

- Review : The publication of this new barometer by the Banque de France aims to shed new light on the financial situation and, in particular, on the debt and over-indebtedness of the French during this difficult period. The current situation is marked by inflation and a national and international political crisis.

- Highlight the relevance of the accompanying arrangements : The Banque de France nevertheless emphasises the effectiveness of the accompanying arrangements set up in France for fragile customers. This scheme serves as 1.7 million requests for information or support from individuals have been addressed to the Bank of France since the beginning of the year, an increase of 7.4% over 2023.

PERSPECTIVE

- Already in June 2023 the Bank of France put the interest of the support mechanism for fragile clienteles and its establishment in France. Despite inflation, the Bank of France experienced a stagnation in the number of so-called fragile customers in Hexagon and even, at that time, a decrease in over-indebtedness compared to 2022.

- The associations also stress the increase in precariousness due to the effects of inflation. Some over-indebtedness cases are marked by very low debt but remain very difficult to repay for the most fragile clients.

Traduit automatiquement via Libretranslate / Automatically translated via Libretranslate