New anti-fraud trio with Google, Swift and AI

The announcement of a new special approximation on the anti-fraud market took place a few days ago. He now binds the giant Google (and more specifically its cloud computing platform Google Cloud) Swift (Society for Worldwide Interbank Financial Telecommunications), the secure messaging network used by financial institutions around the world.

FACTS

-

Swift, the global financial messaging network, has partnered with Google Cloud to develop advanced anti-fraud technologies.

-

This partnership uses artificial intelligence (AI) and federated learning techniques to strengthen fraud detection in international payments.

-

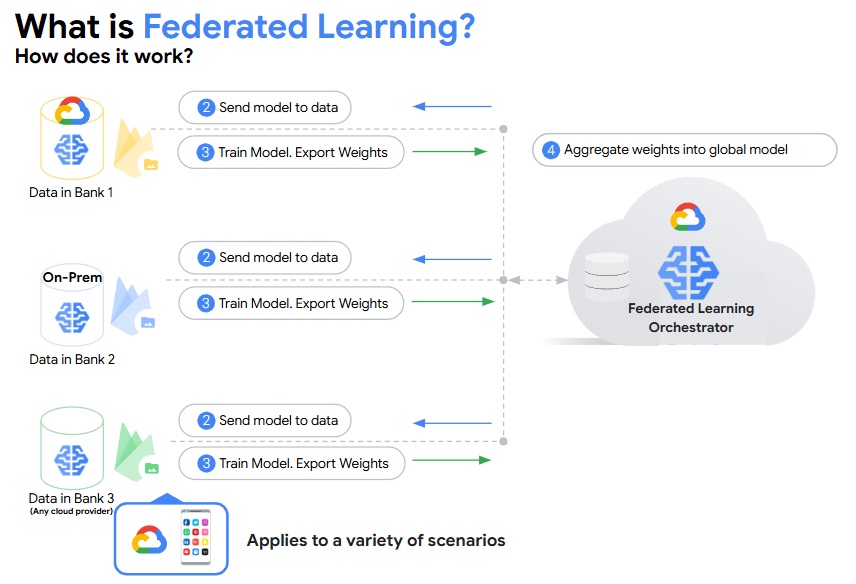

Federated learning is, according to the CNIL definition, a "learning paradigm in which several entities collaboratively lead an AI model without sharing their respective data".

-

Financial institutions can thus train AI models in collaboration while maintaining their sensitive data locally, ensuring total confidentiality.

-

The initiative now linking Google Cloud and Swift also incorporates privacy technologies (PETs) that must enable secure data sharing between financial institutions without disclosing sensitive or proprietary information.

-

The ultimate objective of this association is to propose a solution that preserves confidentiality, adapted to a multi-jurisdictional environment, to combat fraud within the global financial network.

-

The launch of a sandbox with synthetic data to prototype the learning is planned in the first half of 2025. It is based on collaboration with 12 global financial institutions. A first pilot project linked financial institutions in Europe, North America, Asia and the Middle East.

ISSUES

- Confirming ambitions : This rapprochement with Google Cloud is not a first step for Swift in integrating the latest artificial intelligence technologies. The financial courier service provider revealed last October the deployment of an anomaly detection service based on Artificial Intelligence technology to help banks detect and counter potential payments offences. An announcement that took place after the launch last June of two projects based on AI and collaboration in the fight against fraud.

PERSPECTIVE

- The positioning of web giants in the fight against fraud has evolved over the years. Their domination and hegemony in different markets do not ultimately exempt them from accountability. On the contrary, as the latest actions to empower these actors illustrate.

- In the United States, for example, it is the Consumer Financial Protection Bureau (CFPB) which recently decided to continue its work to govern a constantly changing market and marked precisely by the integration of new actors and new offers brought by web giants. After new bases for regulation of the BNPL, it is therefore the GAFA's turn to undergo the Positioning Commission's clear regulation of their financial activities.

- In the United Kingdom last October, things have also changed. The web giant Meta, Facebook parent, there is specified its new anti-fraud commitments closer to two UK banks, Natwest and Metro Bank, to coordinate their action and increase efficiency. A way, too, for the web giant to meet its obligations following the implementation of the Charter on online fraud, signed by the main web players with the British government in November 2023.

Traduit automatiquement via Libretranslate / Automatically translated via Libretranslate