Taptap Send raises funds to lower the cost of money transfers

In the flourishing international money transfer market, the historical services are now being challenged by many new players who are upsetting the established rules. TapTapSend, and its latest fundraising, confirms this trend.

FACTS

- Launched in 2018, TapTap Send offers a mobile money transfer service from 8 countries (France, Germany, Belgium, Spain, Italy, the Netherlands, the United Kingdom and Canada) to 15 others (Bangladesh, Senegal, Cameroon, Ivory Coast, Ghana, Guinea, Kenya, Madagascar, Mali, Morocco, Democratic Republic of Congo, Republic of Congo, Sri Lanka, Vietnam and Zambia).

- The service is now raising $13.4 million in a Series A round led by Canaan Partners, Reid Hoffman and other anonymous investors.

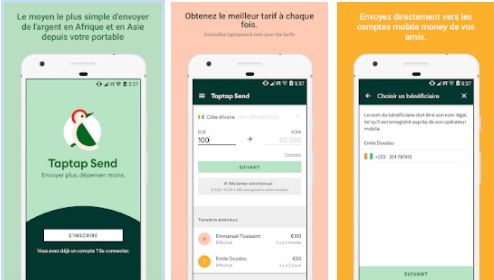

- TapTap Send is based on a mobile application that allows users in the countries offering the service to send money easily from their smartphone to their family or friends in the countries receiving the funds.

- The latter can receive the funds sent via TapTap Send on mobile money accounts and wallets offered by local telecom operators such as MTN, M-Pesa or Orange for example.

- According to TapTap Send, 90% of transfers are made in less than 5 minutes and the service is presented as instantaneous.

- In terms of pricing, the FinTech is counting on

- free service to Bangladesh, Ghana, Guinea, Kenya, Madagascar, Morocco, Democratic Republic of Congo, Sri Lanka, Vietnam and Zambia,

- a fixed fee of 2 euros per transaction charged on shipments to Senegal and the Ivory Coast,

- a fixed fee of 2.50 euros per transaction for shipments to Cameroon and the Republic of Congo,

- a fixed fee of 3 euros per transaction for shipments to Mali.

CHALLENGES

- Making remittances more accountable: The UN has set a goal that prices and fees for remittances should not exceed 3% of the total sent from any service. The overall costs of these services must also be reduced by 2030. TapTap Send is playing just that. The FinTech is the third entrepreneurial achievement of Michael Faye, a development economist who previously worked for the United Nations.

- Expanding its services: TapTap Send does not communicate much about its numbers, but it seems that the application currently has over 100,000 active users per month. It would have allowed hundreds of millions of dollars in transfers. The service would have seen a 5-fold growth in 2020 alone. It will leverage its new funds to expand to new countries.

- Reducing its margins to attract new users: TapTapSend reduces its margins to the maximum and does not charge any commission fees, but rather pays itself on the exchange rates to reduce the costs for its users. Indeed, the operator relies on economies of scale to improve its margins.

MARKET PERSPECTIVE

- According to the World Bank report released last month, cross-border transfers fell by 1.6 percent in 2020 to $540 billion from $548 billion in 2019. A minimal decline in this time of pandemic. Cross-border remittances are a major market and therefore inevitably attractive for many players, increasingly varied.

- Faced with the historical players WesternUnion or MoneyGram, FinTechs and other alternative players are trying to impose themselves today like Remitly, Wise or Nickel for example.