Tanda: a Social Savings App by Yahoo

More and more customers have been adopting next-generation technologies to handle financial management aspects. These customers expect both easy to use and secure services. Yahoo Finance wants to meet these needs with a mobile credit and savings solution, enabling its users to save money through building groups of 5 to 9 people.

The mobile service called Tanda is relatively similar to a typical tontine system, or to a common money pool. Yahoo tries to aim for Millennials: a segment eager to adopt collaborative solutions for managing their budget.

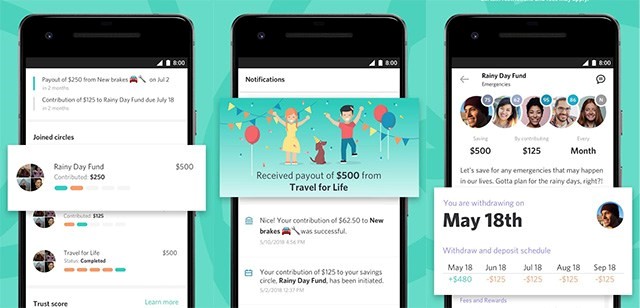

Users are invited to join or create a group of 5 to 9 persons. They will jointly build an online money pool, where each member sends a similar amount of money, every month or every two weeks. Then, each member in his turn is sent the collected amount. The first member would then, in fact, benefit from a free credit. And since the last member receives the amount much later, gets a 2% cashback on the amount.

Tanda also bets on a scoring system to avoid default of payment risks. The more the users successfully take part in these pools, the higher his score. Members’ position, and the order for them to get their refund also depends on this score. Tanda sets the maximum amount for a pool to 2,000 dollars, which is sent to their premium users, i.e.: those with the highest scores. By way of securing this savings process and ensuring members’ commitment, Yahoo partnered with Dwolla, so the identity of the member is verified as they register.

Comments – Web giants making progress in the banking sector

Lately, Web giants, and mostly the big four (aka GAFA), seem to be speeding up the pace of their moves in the banking sector. They challenge longstanding players through crafting innovative solutions based on their skills in data analytics. This is obvious with Tanda: Yahoo’s scoring system makes it possible to monitor risk levels and the health of their financial communities.

According to a study conducted by Bain & Company, one third of the respondents in France would agree to use a financial product or service designed by a leading technological player. Among considered services: P2P payments through Facebook Messenger, Google's payment app, or even Amazon’s credit service for businesses. Yahoo’s new service confirms this increasing interest, and could be seen as an alternative to typical credit card offers.