Mastercard Biometric Payment to Go Global By 2019

In line with current regulatory requirements regarding strong authentication, biometric processes are breaking grounds in the payments landscape. Mastercard believes they should become standard tools for identifying customers. The card scheme announced they would propose biometric authentication services starting next year. This move is consistent with their buyout of NuData Security.

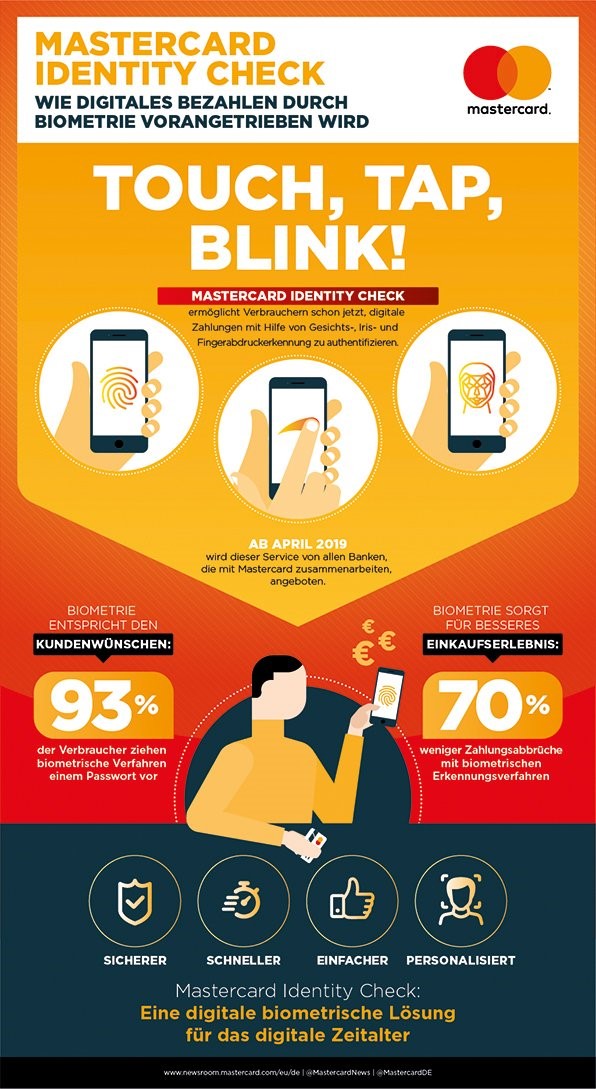

Mastercard unveils a roadmap intended to help retailers, banks and other partners improve payments security based on biometric identification. They should then be able to propose this authentication process in addition to their in place password verification systems. Mastercard Identity Check would then replace SecureCode as of April 2019.

For faster adoption of this authentication method, Mastercard designed an AI-based service. The point would be to improve transactions’ approval processes, while cutting down the number of fraud cases. Also, they developed a mobile app letting consumers monitor their expenses. This option is scheduled to launch in July 2018.

Eventually, Mastercard is developing automation solutions to see the day in October 2018. Once the customer’s card expired, the network will send the relevant card details to his favourite merchants. However, the cardholder will still be able to block some transactions if he so wishes.

Comments – Biometrics: on goes the race

A study by Oxford University showed that roughly 93% of the consumers would rather rely on biometrics than on passwords for authentication. Also, 92% of the surveyed banks want to adopt biometric solutions. Transaction abandonment rates could drop by up to 70% if biometric processes were implemented. These figures easily account for the increasing number of biometric-based payment solutions now proposed.

In light of the competitive pressure imposed by Visa, and even Alibaba, Google or Apple, Mastercard already announced several launches to do with card and mobile payments. In 2016, they introduced their selfie-based mobile payment app. A year later, they presented a biometric payment card (embedding a fingerprint sensor). Mastercard also focused on voice recognition, and worked with Bionym on crafting a heartbeat-based authentication system. Identity Check, for its part, relies on both face and fingerprint biometrics.