SumUp opens its first accounts for professionals

The British FinTech SumUp, which specialises in mobile payment for small professionals and the self-employed, is now continuing its diversification. This time it is presenting a new account offer dedicated to professionals and is moving away from its core business, which is solely focused on payments.

FACTS

-

SumUp has just announced the launch of a new pro account offer, launched simultaneously in France and in Europe.

-

The main target of this offer is professionals, especially shopkeepers and craftsmen.

-

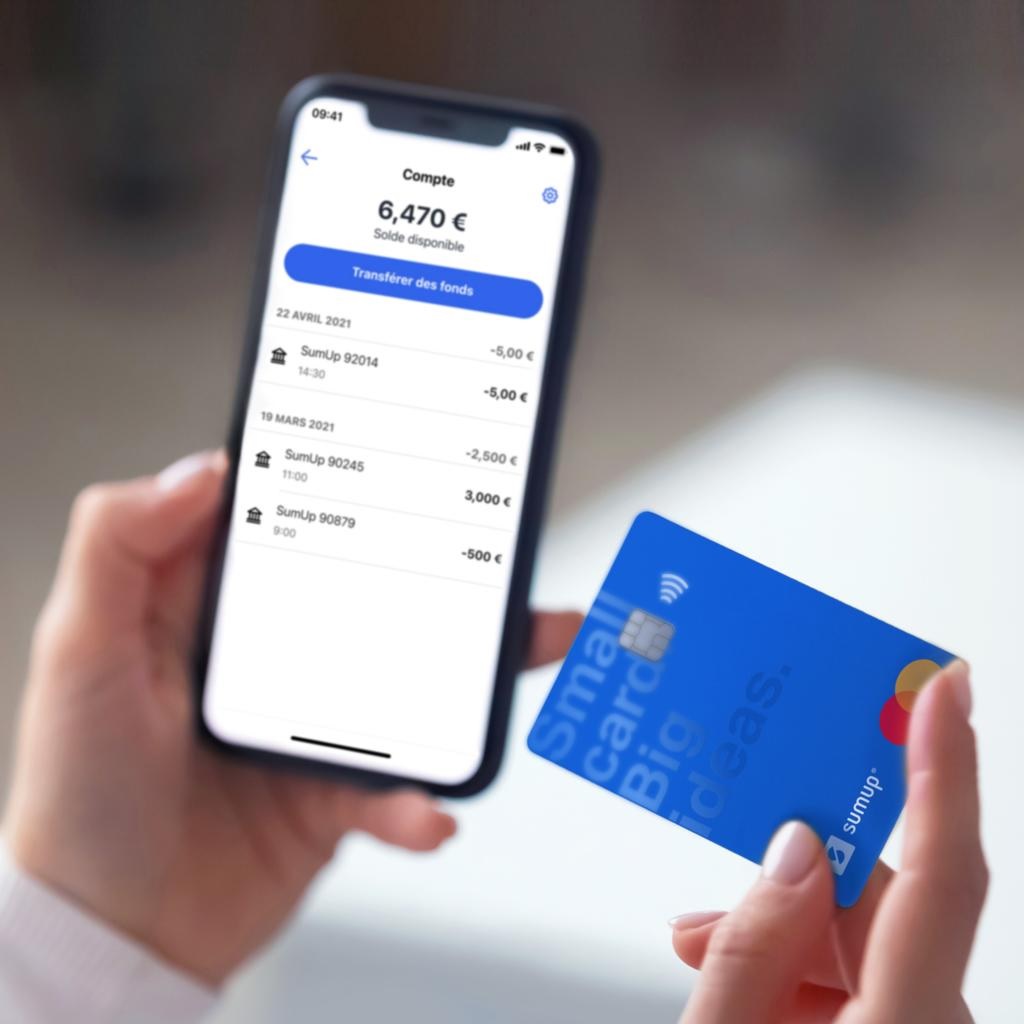

From opening to management, this new "bank" account without a bank will be accessible online or from a mobile phone and will allow its users to manage their money from a single space, linked to their SumUp collection tool.

-

The new SumUp business account is presented as a :

-

a bank without a bank, allowing users to receive an IBAN and a MasterCard,

-

a link between all SumUp services (payment terminals, invoicing, SumUp card, payment by link),

-

accelerate transaction processing (funds collected are accessible the day after the transaction is recorded),

-

liquidity (with the possibility of instant SEPA transfers or invoice payments).

-

-

Opening a SumUp account is free of charge, and there are no fees for managing the account and transactions.

ISSUES

-

A bank without a bank: SumUp does not rely on any banking partnership to propose its new offer. The FinTech is taking advantage of its status as an e-money institution regulated by the Central Bank of Ireland to offer an e-money account associated with its other services, an alternative to traditional bank accounts.

-

A central point of diversification: SumUp presents its new account as the pivotal tool for all its services. Much more than payment, the FinTech has indeed committed to multiplying its services over the years. From pure payment, SumUp also launched a card in partnership with MasterCard before completing its offer with Holvi and finally launching its own e-commerce offer.

MARKET PERSPECTIVE

-

The fundraising by SumUp last March represents a pivotal step in the FinTech's strategy. It announced then that it wanted to accelerate its growth by launching new products and by multiplying acquisitions.

-

Today, it is putting its strategy into practice by accelerating the movement. Because if the FinTech let nearly three years pass between the purchase of shoplo and the launch of its e-commerce offer, it will have waited only a few months to concretise its purchase of Paysolut to launch its professional account.

-

And this appetite seems to be far from satisfied since SumUp has also just acquired Fivestars to accelerate both its geographical expansion and the multiplication of its services.