Stocard Reports Successful Funding Round, Launches in France

Stocard –mobile app for storing loyalty cards on smartphones– just secured $20 million. This funding round led by the Australian financial group Macquarie Capital also involved a certain number of original investors. Stocard now wants to open an office in France and include a payment feature so they may become an all-inclusive wallet.

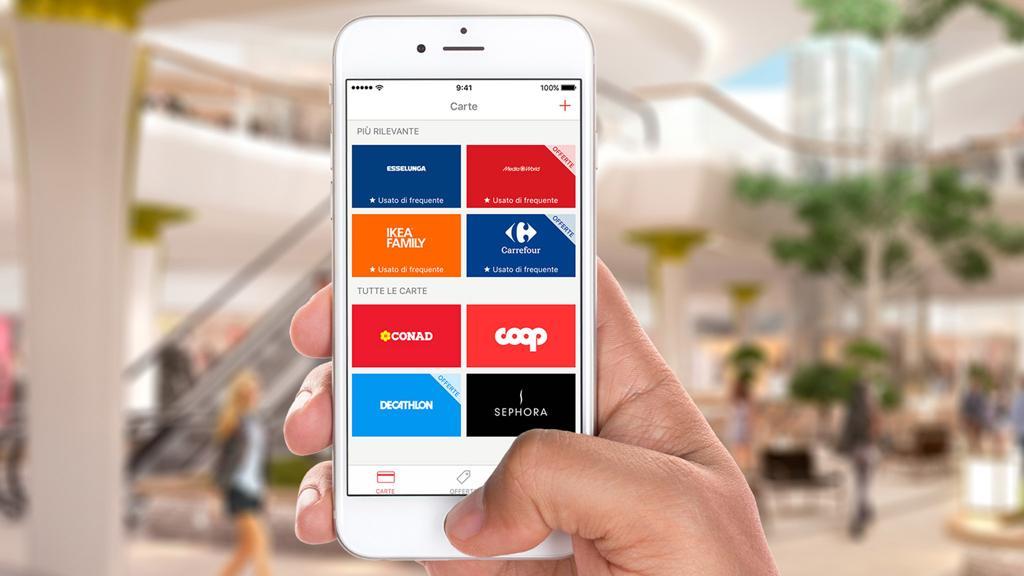

Stocard was founded in 2012 in Mannheim (Germany). Their mobile app lets its users store all their loyalty cards in a single location and have these scanned at checkout via their smartphone.

This service is available free of charge for end users. Their business model relies on conveying promotional offers for partner merchants: their data-based approach pushes customised offers to boost in-store sales (Drive-to-Store). Stocard should then expand their offer through including a mobile payment feature: they may then cover the entire purchasing process.

This start-up already reports 2 million users in France, and 25 million globally. They claim they attract roughly 150,000 new users each month and expect to reach 3.5 million customers in France by the end of 2018.

Comments – Mobile devices as tools for asserting customer loyalty

French consumers generally have 14 loyalty cards, and most of these cards never even leave their wallets. This stresses an actual need for dematerialisation and optimisation. Several start-ups rely on digital approaches making it easier for customers to use these cards. In France, for instance, Fidall proposes an API which has been integrated by Société Générale, and FidMe claims 5.7 million users. They identified and sorted more than 7,000 different loyalty cards. The German start-up joins this race and could become a serious challenger considering their European reach.

Stocard aims for the French market for a good reason: they are already ranked among the Top 25 shopping apps in France, on Google Play and Apple’s App Store. By way of efficiently challenging rival offers, Stocard is expanding their set of services so the app can include a mobile payment feature before the end of this year. They intend to become the reference to fully replace their customers’ physical wallets. And their new financing round should also support their international expansion, including in Canada.