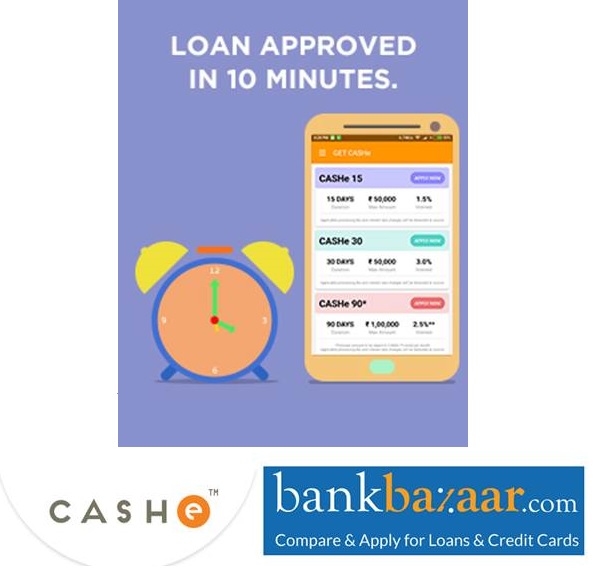

CASHe Partners with BankBazaar On Instant Credit

Instant credit offers are gaining traction quite fast, and the Indian market makes no exception. A few days ago EarlySalary acquired CashCare, now the digital lending company CASHe announces a partnership with the comparison platform BankBazaar on proposing their instant credit offers via their marketplace.

BankBazaar manages an online marketplace enabling individual customers to apply for financial services. Through this partnership, their users may access to instant short-term credit offers, ranging from 10,000 to 200,000 rupees, issued by CASHe. These loans can be paid back over 15, 30, 90 or 180 days (via monthly instalments).

CASHe’s offers are intended for young workers, ages 23 to 35. The borrower’s eligibility is assessed using an algorithm to analyse digital behaviour (including social media). BankBazaar’s users have to fill in a form where they specify their personal and financial data. They can compare several lending offers deemed relevant in their case. The credit decisioning processes only requires a few minutes, the approval (or not) is instantly sent to the applicant.

This Indian FinTech currently processes more than 27,000 loan applications each month. This app has been downloaded 1.8 million times and has 1.5 million active users. It was launched in April 2016.

Comments – India: lending platforms aiming for further diversification

Several FinTech companies started to emerge these past years as they try to address customers who do not have a credit history or access to credit offers, especially in developing countries. The Indian government has been paying attention to increasing banking inclusion rates via relying on a digital approach and their central biometric database (Aadhaar). Considering this huge growth potential, and the development of online lending platforms, CASHe joins forces with BankBazaar.com, a new distribution channel for digital offers.

For a marketplace supported by Amazon, this partnership is a way to provide customers access to a wider range of online financial products, and meet increasing customer demand for personal loans. CASHe relies on partnerships to expand their action scope beyond an initial mobile approach. This bridge-building is also a means to access a broader range of potential customers. So far, this FinTech granted 4 billion rupees in loans (€51 million) and intends for this figure to increase to 9 billion rupees by March 2019.