Starling Bank links bill management and savings

Starling Bank has introduced a new feature to help its customers better manage their budget. The British neo-bank is now offering to use their savings to automate their bill payments. It is moving PFM towards greater planning, in contrast to the current trend of financial immediacy.

FACTS

-

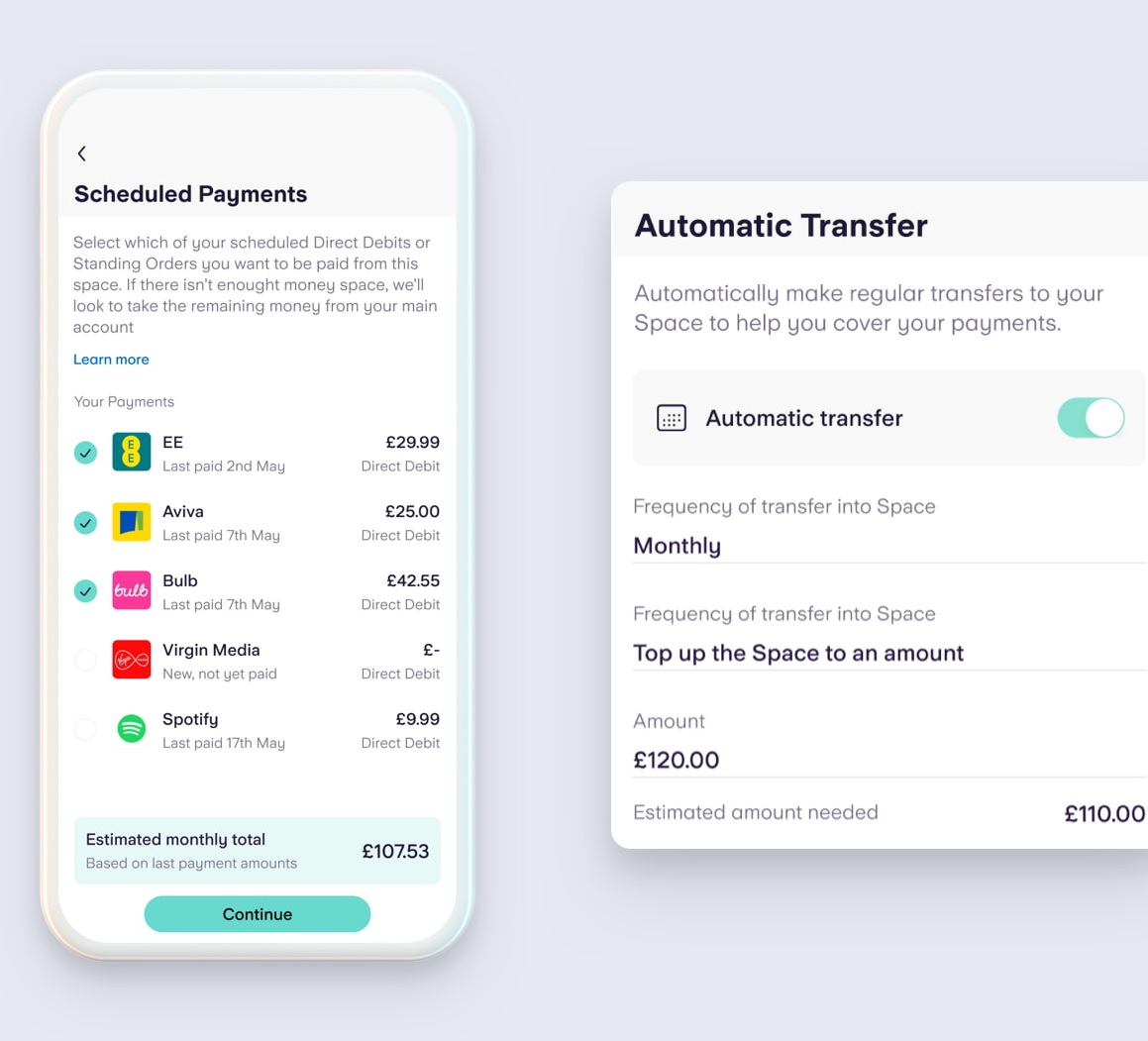

The new service launched by Starling Bank is called Bill Manager. Its principle is simple: to restore the foresight and savings reflex in favor of more moderate financial management.

-

Bill Manager matches the payment of recurring bills owed by Starling Bank customers with a portion of their savings.

-

Bill payments are no longer made from the customer's current account but from a specific savings area.

-

The service thus encourages customers to allocate part of their finances to the payment of their future bills and other recurring debits: rent, subscriptions and other energy services for example.

-

To create a savings area attached to Bill Manager, Starling Bank customers must:

-

access their savings area,

-

click on the "Manage Space" button,

-

click on a new feature: "Pay bills from this space".

-

-

A notification is sent at the time of payment. A tab allows you to consult all the last transactions made from a "Space" attached to the Bill Manager service.

-

If a "Space" runs out of funds, Bill Manager will send notifications to the Starling Bank customer in advance of his debit or invoice payment date. Payments will be rejected if the Space is not replenished.

ISSUES

-

A co-created service: While the savings "Spaces" represent one of the most requested services by Starling Bank customers, the neo-bank specifies that the launch of Bill Manager is a response to the expectations of these same customers, who want to take advantage of an optimized solution for financial prevention and bill management.

-

Rethinking the management of daily finances: In essence, Starling is opening up the possibility of automatically debiting a savings account. In form, Starling Bank's new service is based on the creation of savings subspaces, a service that is quite common and popular among neo-banks. These accounts are often oriented towards the purpose of saving, the originality of this new service is to use it for budget management purposes.

-

Catching up with the competition: Starling Bank's main competitor, Monzo, has been offering a similar feature for several months. But part of this service is integrated into its Monzo Plus offering and is therefore not free. Starling offers its new feature for free.

-

Less immediacy, more weighting: While one of the main financial trends today is that of BNPL, Starling Bank is reversing new habits to promote greater anticipation of personal spending. Because while split payments promise to restore purchasing power, the practice actually increases the risk of overconsumption and overindebtedness.

MARKET PERSPECTIVE

-

While the critics are growing, to underline the increasing risks of BNPL as the offers multiply. With its new service, Starling Bank is trying to put reason back at the heart of financial management by reminding people that savings represent a major risk prevention tool.

-

Other players are also moving in this direction, such as FinTech Accrue Savings, whose entire offering is designed as an "anti-BNPL" response.