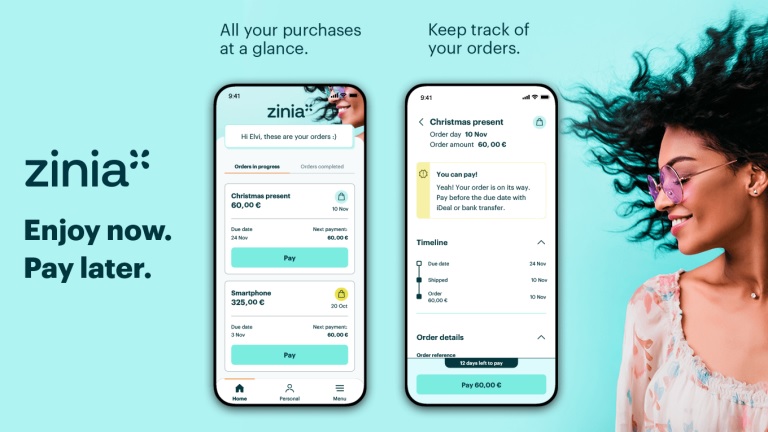

Santander supports its own BNPL offer with Zinia

Spanish bank Santander does not intend to let specialist FinTechs take all the shares of the buoyant BNPL market. It is now rolling out its own Buy-Now-Pay-Later service called Zinia in Europe, after a successful launch in Germany.

FACTS

-

The Spanish bank chose to launch its own BNPL service on the German market first.

-

The technology behind Zinia has been tested there for a year now. It has proved its worth there, as it has managed to convince some 2 million customers locally.

-

On the strength of these results, Santander now intends to roll out its offer. The Netherlands is presented as the first country targeted, but it should be followed by the countries of Northern Europe, the United Kingdom, France and Italy.

-

Zinia offers a relatively standard BNPL service, allowing consumers to pay for some of their purchases in interest-free instalments, either online or in physical shops that accept the service.

-

Santander relies on a network of retail partners to extend its offer.

CHALLENGES

-

Complementing its offer: Santander already boasts consumer credit for more than 19 million customers at more than 63,000 affiliated merchants. Its BNPL offer is a natural complement to an already broad offering. Santander Consumer Finance currently manages €120 billion of assets in 18 countries.

-

To differentiate its offer, Santander emphasises its status as a regulated bank and its commitment to presenting one of the safest offers on the market. It relies in particular on the real-time scoring technology, based on artificial intelligence, of its online bank Openbank. The latter already has 1.7 million customers in five countries in Europe and America.

MARKET PERSPECTIVE

-

Zinia is the first project developed by Santander's Digital Consumer Bank (DCB), which combines Santander Consumer Finance (SCF) and Openbank.

-

Nevertheless, the Spanish bank is seeking to be dynamic and responsive in order to position itself in new markets and to present new services in line with the times, in the face of new competitors. With varying degrees of success.

-

In 2020, for example, Santander launched itself on the British market for international money transfers. It presented its service, PagoFX, as a direct response to innovative offers such as Wise. The closure of this service was finally announced last November.