REX: Starling Bank Grows Stronger, Aims for Europe

FACTS

- The British challenger bank Starling Bank goes back over their business evolution and growth perspectives in light of promising results achieved over the past 8 months.

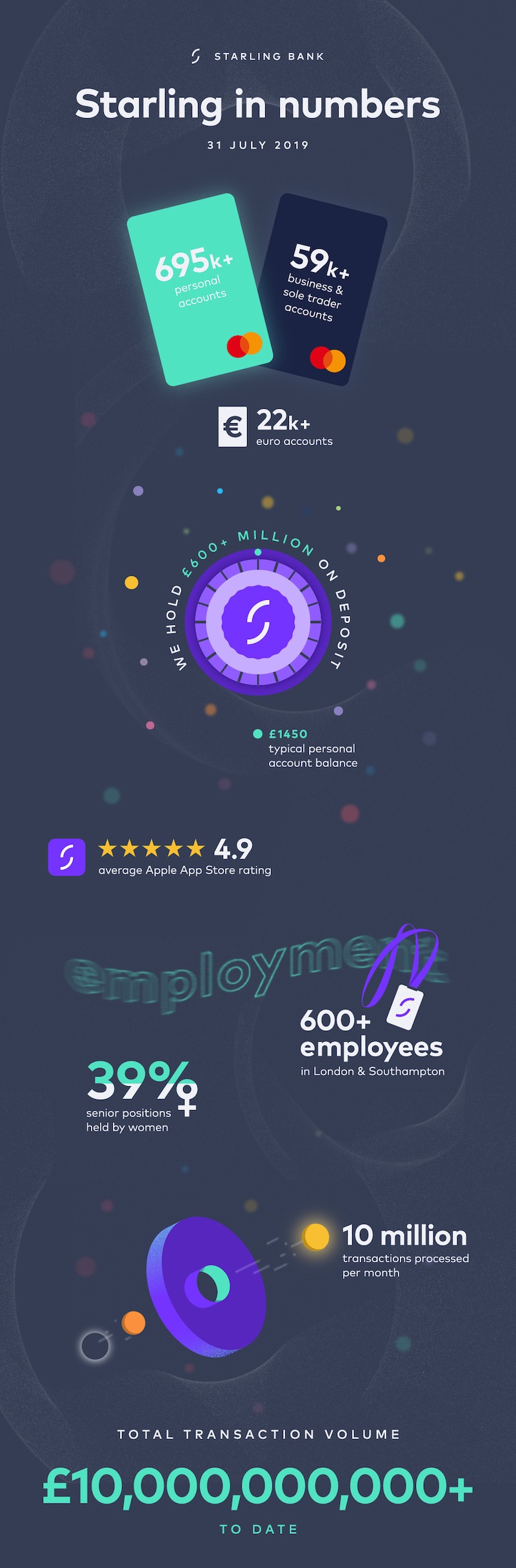

- Since November 2018, their BtoC and BtoB customer base increased more than twofold, from 385,000 to 776,000 accounts (717,000 retail current accounts and 59,000 SMEs).

- In the meantime, they went from £202 million to over £600 million in total deposits (close to 300% increase). They expect to top £1 billion in deposits and attract one million customers by the end of 2019.

- Typical personal account customers reach an average balance of over £1,450, while business accounts average at more than £10,500.

CHALLENGES

- Soon a profitable challenger bank. Considering recently released figures and observed growth, Starling Bank deems they will reach profitability by the end of this year. Beyond their race for attracting customers, they showed their business model actually is viable. Their results also stress they are not just a secondary bank for their customers.

- on SMEs. Their number of corporate customers increased twofold as well, from 19,000 to 59,000 SMEs. They now target a 6.7% share of the SME banking market within five years and have undertaken to invest nearly £95 million in achieving this goal.

- Consolidating their marketplace. Eight new partners entered Starling’s BtoB marketplace in 2019. And the FinTech intends to expand to 50 new partners over the next four years.

MARKET PERSPECTIVE

- Now that they broke even in the UK, Starling sets forth European expansion plans. They already entered Ireland and are hiring country managers for their future subsidiaries in the Netherlands, in France and in Germany.

- In France, another neo-bank, N26, could hit the 1 million customer threshold this year: they now claim 900,000 customers on this market (3.5 million in Europe). Meanwhile, they also set sights on a future IPO (within 3 to 5 years).