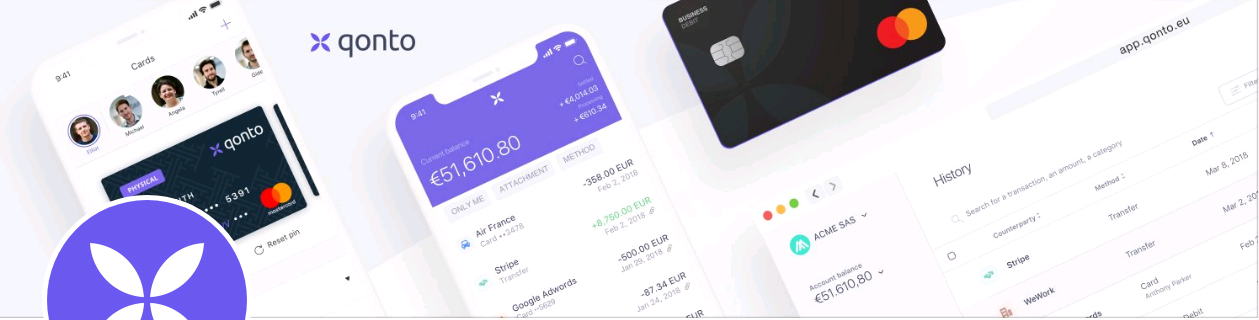

REX: Ongoing Success for Qonto

FACTS

- The French neo-bank Qonto was launched in July 2017 and just reported €3 billion in processed transactions: this figure actually doubled in 5 months.

- They claim more than 25,000 corporate customers for their mobile bank, vs to 10,000 in April.

Qonto in France:

- The first BtoB-dedicated neo-bank in France to have been granted Payment Institution status by the ACPR

- 25,000+ customers

- 110 employees in Paris

CHALLENGES

- In line with the underway government-planned SME-applied digital transformation, the idea is to help them manage their finances more easily or via an online service for capital deposits. Qonto lands on a crowded market already invested by many players: some with global ambitions (N26 and Revolut, for instance) others focusing on more industry-specific services (iBanFirst and Margo Bank).

- Take advantage of their ACPR approval to build their own banking system and attract more businesses in France, via reducing account opening delays.

- Rely on their success in France to expand their set of services to other countries by 2019, including Spain, Italy and Germany.

MARKET PERSPECTIVE

- Qonto addresses corporate and self-employed customers and will rely on their latest €20 million funding round to aim for EU-wide reach just like other challenger banks before them (N26, Revolut, Bunq, etc.).

- This investment should also contribute to helping them attract more than 100 agents in 2019 and craft new products based on their ACPR approval.

- With this announcement, Qonto shows that alternative banks still appeal to customers interested in a renewed experience. However, it is still impossible to be sure that these alternative models will last and become profitable. A recent study by the ACPR stressed their ability to win customers as much as difficulties in building viable business models.