Price increase for PayPal business customers

PayPal has updated its price list for its services intended for its American professional customers, in particular small and medium-sized businesses. Carried by figures in strong acceleration, the American giant of the electronic payment feels in capacity to impose its prices; a decision which could nevertheless leave it more vulnerable in front of the competition.

FACTS

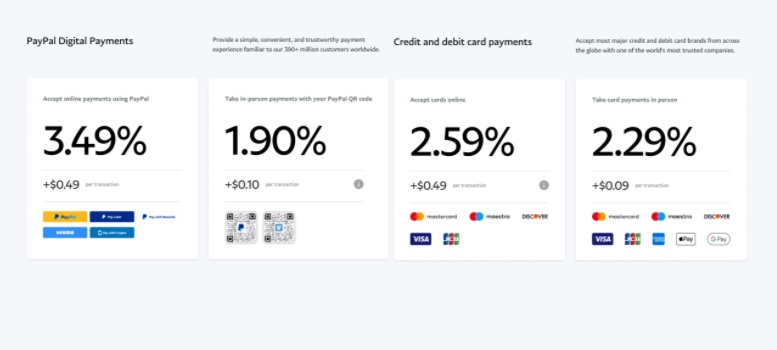

- PayPal's payment products such as PayPal Checkout, Pay with Venmo, PayPal Credit, Pay in 4, PayPal Pay with Rewards, Checkout with crypto, which include seller protection on eligible transactions, will see their rates increase to 3.49% + $0.491 per transaction starting August 2.

- Paypal or Venmo's QR code payment services will remain unchanged:

- 2.40% + $0.05 for transactions under $10,

- 1.90% + $0.10 for transactions above that amount.

- A pricing effort has been made by PayPal for processing online payments made with Visa and Mastercard debit and credit cards to better compete with its main rivals such as Stripe and Authorize.net

- These announcements have driven PayPal's stock price higher.

KEY FIGURES

- PayPal has 392 million active accounts, including 31 million merchants worldwide.

- According to PayPal, consumers who choose PayPal as a payment method are 60% more likely to complete their purchase than consumers who choose other online payment methods.

- Consumers are nearly three times more likely to complete their purchase when PayPal is available at checkout.

- The recently announced Buy Now, Pay Later solutions have resulted in a 15% increase in payment volume for businesses.

CHALLENGES

- Reposition the value of its offering: For PayPal, this increase in fees is justified by the many features that have been added to its tools, in particular new fraud analysis services, as well as other payment options such as Pay in 4 (BNPL), at no additional cost to the consumer.

- Establish its status as a key intermediary: Despite the dynamism of this market and the growing importance of competition, PayPal's strategic choice to position itself at both the payment and consumer levels gives it a key position vis-à-vis merchants, as evidenced by the statistics revealed by PayPal concerning its conversion rates.

- Accelerate to fulfill its ambitions: Other mega-players are starting to emerge on the market, starting with Klarna, which with its record valuation no longer denies itself any ambition. Its shopping application, which is particularly aimed at merchants by promising them a range of services related to payment and beyond, could overshadow PayPal, which is also aiming for the super app model.

MARKET PERSPECTIVE

- PayPal's decision illustrates the challenge of the platformization of the economy and the omnipotence of the GAFAs. Their strength in certain sectors raises the issue of market access and the regulation necessary for the proper development of economic activity.

- Reuters called PayPal's increases "a bold move in an increasingly competitive digital payments industry."