PayPal Credit Programme Expanded

FACTS

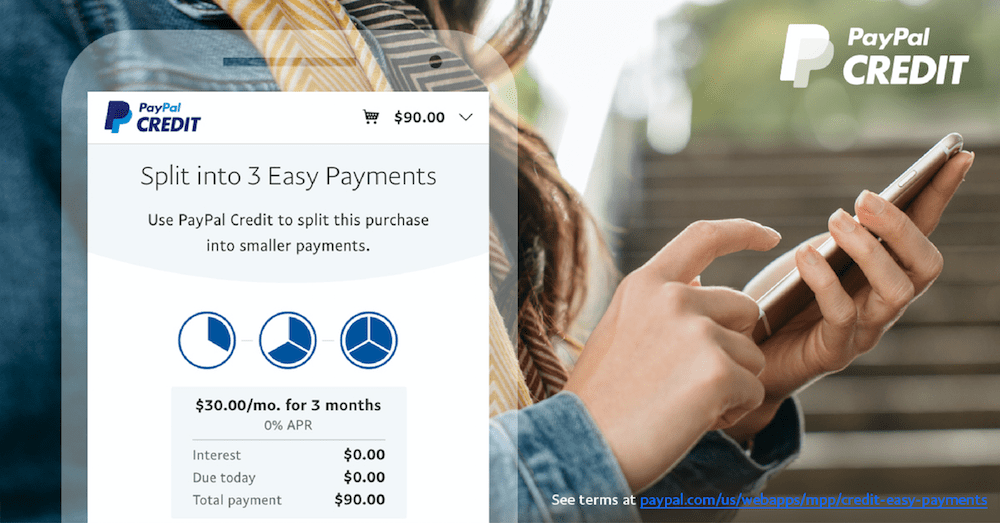

- In line with their PayPal Credit programme, PayPal chooses to expand their range of financing offers to include purchases starting at $30 (vs $99 until then), enabling users to pay in 3 instalments interest-free (vs 6 instalments for $99 or more).

- How it works. PayPal Credit is a reusable cash reserve allowing customers to purchase goods and services on credit, online. If approved, credit lines may start at $250. The option comes free of charge if the user pays back within 6 months; beyond this deadline, interests are charged. From now on, with purchases worth over $30, a 3-month period applies for repayments.

- This option is currently tested with their banking partner Synchrony Bank, and is expected to roll out in 2020.

“With 45% of PayPal Credit volume on mobile, consumers are looking for seamless, mobile-first financing options for purchases at increasingly lower ticket sizes.”

Source: PayPal

CHALLENGES

- Aiming for more targets with a credit offer. For US consumers, this service is a means to rely on a flexible, transparent and secure payment option, consistent with PayPal’s brand image. These expectations especially prevail when considering mobile payments. PayPal may then reach out for more customers while increasing their revenue.

- Securing customer loyalty. E-merchants, for their part, are provided a means to improve their online visibility and increase their customer base. The point would be to generate more revenue through relying on the e-payment platform’s popularity. They also observed a 15% increase in sales on average (source: PayPal) once PayPal Credit implemented.

MARKET PERSPECTIVE

- This service fits in a trend which sees Buy Now, Pay Later options being added by a great number of industry players.

- PayPal claims roughly 286 million active accounts and 23 million merchants. Besides, in 15 years, PayPal Credit reached $50 billion in total payment volume.