Online shopping has become a habit according to an Adyen/Ipsos survey

Boosted by the health crisis, the e-commerce market now concerns almost all French people. 97% of them have already bought online according to the latest Adyen study carried out by the polling specialist Ipsos. A study that highlights new uses, but also points to areas for improvement.

FACTS

-

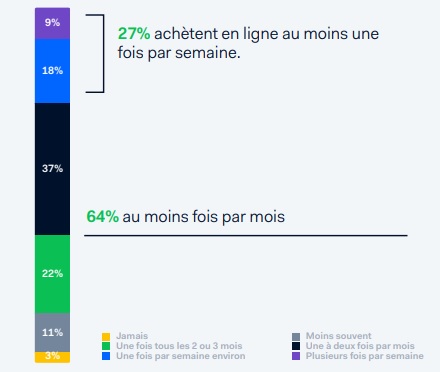

E-commerce has exploded, but the main finding of Adyen's study is that this market has become part of the consumption habits of the French. 64% of them buy online at least once a month, 27% even buy online at least once a week.

-

More than one in two French people spend more than €50 per month online and 23% spend more than €100. On average, the amount spent online by the French is €84.

-

The typical profile of the regular online buyer is that of a 35 year old consumer, with a high social status and children.

-

Uses

-

While new consumer habits have exploded, payment habits remain the same. Thus, 69% of French people mainly use the card to make their online payments.

-

Despite the bad press, BNPL's services are attracting consumer interest. 9 out of 10 French people are aware of the multi-payment option and half of them are interested in this service for payments of more than 230 euros on average.

-

-

Security

-

The security of transactions is the first criterion identified by the French to validate an online purchase.

-

The French have expressed their confidence in the 3D Secure protocol. 90% think that confirmation by SMS really protects online payments.

-

More than a third of the French also save their banking data online. However, this use depends particularly on the frequency of purchases. Thus, this share rises to 50% for French people who make online purchases every week.

-

Furthermore, although 81% of French people expect new technologies to make payments more secure over the next decade, only 30% of them use biometric payment devices to date.

-

The Adyen/Ipsos study was conducted on 28 and 29 September among 1,000 people aged between 19 and 75 years old, representative of the French population.

CHALLENGES

-

An acceleration to come: Unsurprisingly, the Adyen study reveals a strong disparity in habits and highlights the appetite of younger people to opt for the most innovative solutions. Thus, if the pandemic has accelerated the transformation of uses, new norms will be imposed as the digital natives become part of the consumer base.

-

For example, among 16-24 year olds :

-

81% have at least one online subscription (vs. 49% for the rest of the consumers),

-

73% are interested in paying in instalments (vs 49%),

-

57% register their bank details online (vs 36%),

-

39% have made payments on social networks (vs. 15%),

-

70% use biometric payment (vs 30%).

-

MARKET PERSPECTIVE

-

The Adyen and Ipsos study highlights the major trends already felt following the pandemic with regard to e-commerce and online payment.

-

It nevertheless highlights the major work that remains to be done to further modernise the trend. In particular on the theme of payment methods, since the card, although poorly adapted to this purchasing channel, remains a preferred tool for consumers who are still not used to payment applications and other e-wallets (only 24% of consumers).