Oney makes fragmented payments universal

Oney, an innovative player in the payment sector, is looking to revolutionize the fragmented payment market with a new proposal that allows its users to apply its fragmented payment offer at any merchant in France and abroad. This initiative is reminiscent of the strategy of Klarna, which has just entered the French market.

FACTS

- Oney, a subsidiary of the BPCE group, co-owned by Auchan, is an innovative player in the field of payment. They have been offering fragmented payments since 2008.

- Today, they are one of the main players on the French market with 1.4 billion euros in outstandings (i.e. 1/3 of purchases made via this payment method) and 2.8 million customers out of the 8 million that the Oney group has.

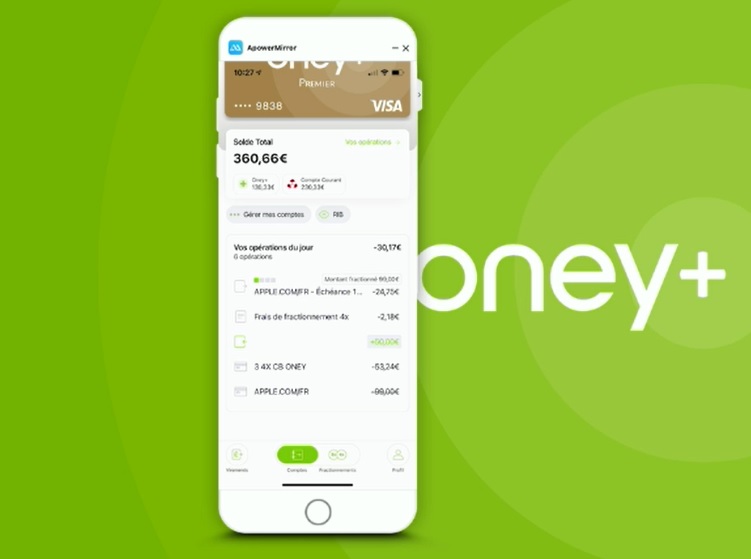

- To take things a step further, Oney is presenting Oney+, which consists of a card, a mobile application and a fragmented payment offer that is described as universal, i.e., it can be triggered regardless of the merchant where the expense is made, in a store or online, in France or abroad.

- The application allows users to aggregate all their bank accounts and choose which account to debit for each expense made with the Visa card issued by Oney. It also offers an instant view of each expense, with the option of applying or not applying the split after the fact, from the mobile application.

- The rates are clearly displayed at the time of the splitting operation:

- 1.45% for a payment in 3 installments (or maximum 15 euros)

- 2.20 % for a payment in 4 times (or maximum 30 euros)

- The amount of split purchases is limited to 1,000 euros over 3 months.

CHALLENGES

- Be at the forefront of innovation: While Klarna is entering the French market with its fragmented payment offer and launching its universal fragmented payment application and service (not linked to a merchant) only in the United Kingdom, Oney is getting ahead of the FinTech star by launching universal fragmented payment in France before it. This post-purchase split is a facility that is not offered by the other players in the market (notably Floa). Only FinTech Curve has experimented with it in the UK with its Go back in time feature.

- Facilitating budget management: Oney also wants to simplify budget management for its customers with a range of tools accessible through account aggregation. Splitting is at the heart of this value proposition, which aims to enable consumers to better manage their spending. The possibilities offered by open-banking are not directly exploited to score the customer, but the usage data from the card and the app will be added to give Oney more precision, on a product that the FinTech considers low risk given the amounts and repayment periods.

MARKET PERSPECTIVE

- Oney offers one of the fastest subscription processes on the market, in less than five minutes.

- This offer was developed by 150 Oney employees in one year.

- Facing the current criticism directed to fragmented payments, Jean-Pierre Viboud, Oney's CEO, defends this model, which, thanks to its very short, is more conducive to repayment than traditional credit products. In fact, the rate of non-payment is the lowest of all the credit products offered by Oney (less than 1%).