One year after its launch, Younited Pay launches in Spain

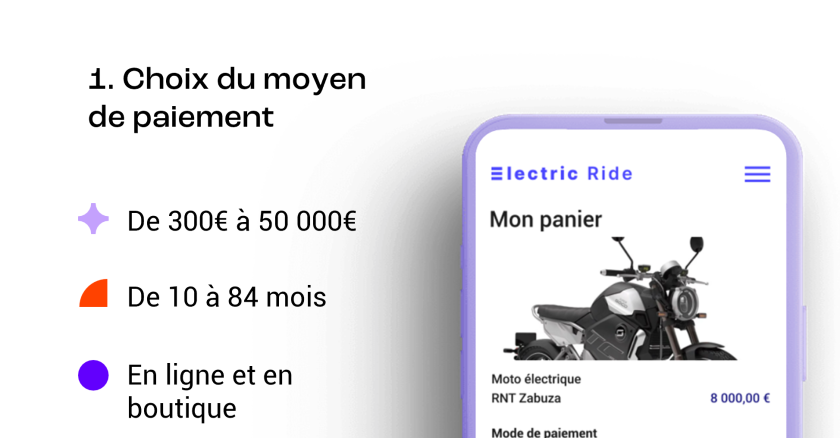

Younited, the European leader in "instant credit", reveals a positive balance sheet and outlook, 12 months after the launch of Younited Pay on the French market. Younited Pay is a payment solution that allows merchants, on their website or in their stores, to offer their customers instant credit to finance shopping carts of up to €50,000 for up to 84 months.

FACTS

-

Younited Pay is attracting many merchants. More than 2,000 merchants have already opted for its payment facilities.

-

This fast-growing "Partnerships" channel (+185% of the GMV in 2022) is a key development lever for the company.

-

Younited Pay has several reference partners, such as Bouygues Telecom in France, the leading retailer Euronics in Italy in the world of electronic goods, Tediber in home furnishings, Cake in the world of electric motorcycles and Auto1 in the used car market.

-

The deployment of the service on the Prestashop and Magento e-commerce platforms, and soon on Shopify, should further accelerate its adoption by e-retailers with less technical resources than the big players in the sector.

-

-

The solution is used both online and in physical stores: nearly 70% of Younited Pay transactions are made in-store.

-

For merchants, the impact on sales is significant. On average, merchants see a 25% increase in average shopping basket and a 15% increase in revenue.

-

Payments are 100% guaranteed to the merchant, and some merchants report that the penetration rate of Younited Pay can reach up to 60% of the payment mix.

-

-

Building on its success in France and Italy, the solution is now being rolled out in Spain.

-

Already present in this market since 2017 through its historical personal loan business, Younited relies on its local teams based in its Barcelona and Madrid offices, where around 100 employees manage the relationship with customers and merchants.

-

A first partnership has already been successfully launched with K-tuin, the largest distributor of Apple products in Spain. Younited Pay allows customers to finance the entire range of Apple products when making an online or in-store purchase.

-

CHALLENGES

-

An offer that anticipates future regulations : The current revision of the European directive on consumer credit will indeed reshuffle the cards in the industry, since unregulated installment payment offers ("Buy Now Pay Later") will now be regulated in the same way as traditional credit. Younited, which has already accumulated several years of experience in the regulated consumer credit market, considers itself better equipped than the BNPL players to deal with the future European directive.

-

A solution powered by open banking : The Younited Pay solution is based on Open Banking, which allows users to securely share their bank account history and also optimizes financing rates for merchants. By analyzing this bank data, the technology developed by Younited is able to score and validate a customer's repayment capacity in a matter of seconds and provide an instant final answer.

MARKET PERSPECTIVE

-

European Union member states have agreed on a legislative project to modernize the framework for financial services sold online. This new directive will complement the directive governing consumer credit and specifically targeting BNPL-type products.

-

While the Brussels proposal went in the direction of a strong harmonization of these provisions, by detailing for example the list of pre-contractual information to be provided, the compromise reached in the EU Council leaves each Member State free to place the cursor where it wishes on certain key points.

-

The obligation to provide precise information on "hidden costs" or on the risk linked to the financial service in question disappears from the text.

-

Similarly, while the Commission intended to require that this information be provided "at least one day before" the conclusion of the distance contract, the Council's version provides for this to take place "at the right time" ("in good time" in the text). A vague formulation, already used in the new directive governing consumer credit, and intended to give each Member State room for manoeuvre when transposing the text into national law.

-

On the other hand, the Member States endorse the obligation for sellers to facilitate the right of withdrawal within 14 days of the conclusion of the contract: they will have to provide users with a "withdrawal button" allowing them to easily withdraw from the sale.