OCR and AI Helping Customers Refinance Loans Faster

The Swedish FinTech Anyfin is focuses on refinancing consumer loans and credit card debt. They just raised 4.8 million euros in Series A funding led by Accel and Northzone, as well as Global Founders Capital (Rocket Internet’s Venture Capital fund). The idea is to help borrowers refinance their credit based on OCR and AI technologies.

Anyfin was launched in November 2017 to focus on consumer credit consolidation via a new online and mobile platform. Their solution makes it possible to analyse the borrower’s profile to propose more relevant refinancing alternatives.

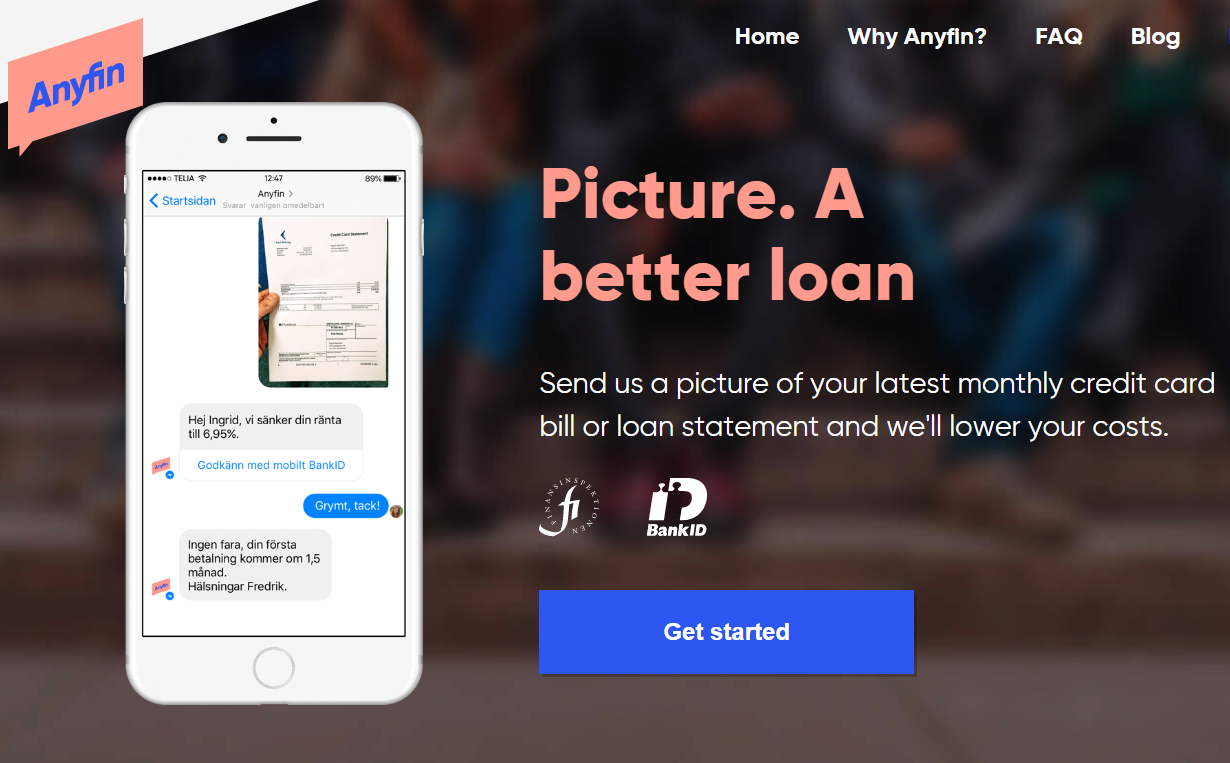

The borrower sends a picture of his existing loan statement via e-mail, SMS or Facebook Messenger. This start-up relies on optical recognition technologies to retrieve the required information regarding the loan and the customer (banking details, repayment history, amount and characteristics of the existing loan, etc.) and proposes an option to refinance the loan at a better price.

The applicant’s creditworthiness is assessed using publicly-available consumer data from credit bureaus. AI technologies are used to identify the type of data being retrieved from the statement’s picture, qualify it, and send an answer within seconds. If the consumer agrees with the new option, Anyfin takes care of settling the previous loan and subscribing the new one.

Comments – Credit repurchases in the AI era

Anyfin explains that customers in Nordic and continental Europe are paying way too much for finance. This Swedish start-up deems that next-generation technologies can help remedy this situation. Their promise consists in reducing credits’ costs: they believe that a new customer may be able to save up to half of this cost. They also hope to stand out as a game changer through praising "fairness and transparency", as opposed to other currently available offers. This FinTech relies on a smooth, user-friendly and fully automated customer experience, as their data processing is partly based on AI techs. This choice makes it possible for them to speed up credit-granting processes, and propose lower credit prices.

For now, Anyfin only addresses the Swedish market, but is aiming to reach out for other European countries, eventually. This new investment they secured will first help them grow on their current market, but will also contribute to further product developments and partnerships.