Nickel clarifies account statements

BNP Paribas' subsidiary Nickel has just made official its new partnership with a British player. The company is Snowdrop Solutions, a technology specialist in data and location technologies. Their joint work has resulted in the enrichment of payment information presented in Nickel's customer statements.

FACTS

-

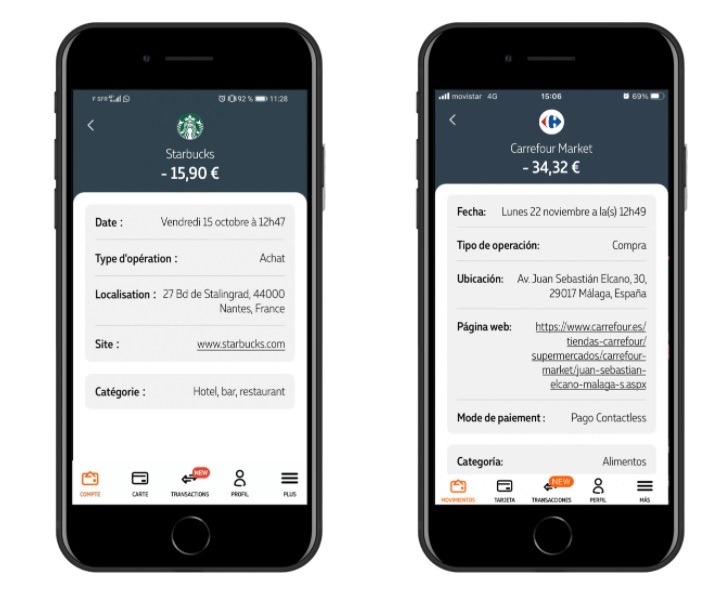

Nickel, the "bankless" bank, has teamed up with Snowdrop Solutions to help its customers better understand their purchasing habits and, above all, their past transactions. More concretely, Nickel wants to make the transactions presented on its account statements more readable.

-

How can this be done? Through data. Snowdrop Solutions makes it possible to enrich the information on payment transactions presented in the account statements by associating to each operation :

-

a clear title,

-

the brand name or the legible name of the merchant where the transaction was carried out,

-

the merchant's logo,

-

their precise address,

-

a link to the merchant's website.

-

CHALLENGES

-

Clarifying exchanges: Clarifying account statements and the transactions presented is a simple way for a financial service provider to avoid misunderstandings and undue complaints.

-

Fighting fraud: At the same time, the new service offered by Snowdrop Solutions makes it easier for customers to detect suspicious activity and block their card more reactively if necessary, thus preventing further fraud.

-

Optimising the relationship: The initiative reduces the work of bank staff in clarifying the situation for customers, promotes customer autonomy and overall customer satisfaction.

-

A new sign of European deployment: To meet its extra-national ambitions, Nickel has relied on a British player that has global scalability and will enable it to deploy this new service in different geographies. Last April, Nickel stated that it was preparing for operational deployment in Belgium and Portugal by 2022 and that it planned to be in six new countries by 2024.

MARKET PERSPECTIVE

-

In March 2019, Apple struck a blow with the Apple card, particularly on the subject of clear and geolocalised identification of expenses. Banks will have taken almost two years to catch up. This functionality is beginning to be democratised and promises improvements in terms of budgetary advice.

-

With regard to account statements in particular, Banco Sabadell presented a 2.0 model based precisely on the use of data last March.