Fly Now Pay Later, or the adaptation of BNPL to the travel market

A recent fundraising round has highlighted a growing trend in the adaptation of split and deferred payment solutions to the travel market. The aptly named specialist finTech Fly Now Pay Later is demonstrating this today.

FACTS

-

Fly Now Pay Later has just completed a new debt financing round for $75 million. Its main investor is the Atalaya Capital Management fund.

-

This financing will primarily enable Fly Now Pay Later to expand its offer in the United States. The service, which has been operating in the country since 2020, has suffered from the crisis but has made this market a priority for 2022.

-

Fly Now Pay Later presents itself as a specialist BNPL player, with coverage of the UK, European and US markets.

-

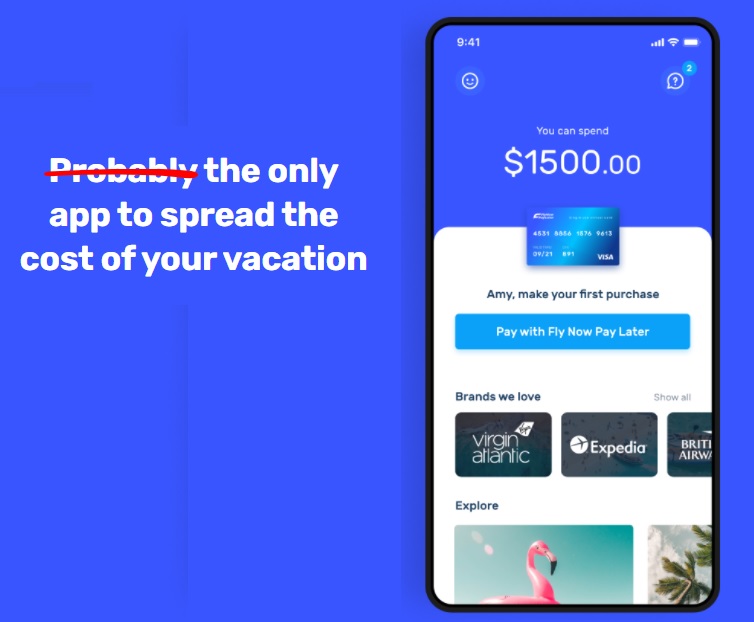

It allows its customers to spread the cost of a trip over up to 12 monthly payments by using its travel partners or simply its mobile app to book their hotel, flat or flight.

-

The service is available free of charge but relies on late payment penalties of up to 29.9% to earn its fee.

CHALLENGES

-

Recruiting: Founded in 2015, Fly Now Pay Later currently employs 90 people in the UK, US and Latvia. Its teams will need to accommodate more than 250 additional people by 2022.

-

Boosting its deployment: Fly Now Pay Later already had partnerships with Booking.com and hotels.com, as well as contracts signed with companies such as Malaysia Airlines and British Airways. Its new round of funding should help it to convince other new partners to distribute its offer more widely.

-

A booming market: Juniper Research estimates that BNPL's offerings will represent more than 50% of the integrated finance market by 2026. Another Statista study predicts that spending on domestic travel in the United States should reach nearly $968 billion by 2024. Both of these markets are growing rapidly and are currently covered by Fly Now Pay Later.

MARKET PERSPECTIVE

-

Last May, an American Express survey revealed that 36% of consumers would have liked to take advantage of a more flexible payment option, such as BNPL, to pay for travel. It was on the basis of these results that American Express presented an adaptation of its Plan It service, allowing its customers to pay for their air travel via an adapted BNPL solution.

-

Since then, this type of offer promising to adapt fractional payment to the tourism market has been deployed. Specialist sites such as Carnival or Expedia (with Klarna) are now offering these financing packages to satisfy consumers' appetite for travel, after a difficult period of containment.

-

Several global airlines, including Lufthansa, Aeromexico, United, TAP Air Portugal, Fly Porter, Sunwing and Alaska Airlines, have also joined forces with Uplift, a BNPL player specialising in the travel sector.