Nets and Ethoca fight against chargeback

Nets, the Danish financial services specialist acquired by Mastercard, has just made official its partnership with Ethoca, a global provider of technological solutions based on collaboration between payment card issuers and e-retailers. This partnership is headed by MasterCard, which has been very involved in the fight against chargebacks for several years now.

FACTS

-

Ethoca is the world's largest collaboration network, building relationships with leading card issuing banks, merchants, processors, software providers and fraud platform providers worldwide.

-

The main objective of the new partnership signed between Nets and Ethoca is to improve the sharing of payment transaction information between merchants and payment issuers.

-

The partners believe that this will reduce the resolution of disputes and even, in the longer term, reduce chargeback procedures.

-

Nets' customers will have access to Ethoca's global fraud and purchase data network. Issuers will even be able to share information on confirmed fraud and customer disputes directly with merchants and banks via Ethoca Alerts.

-

Issuers will also have access to details of purchases made at merchants.

-

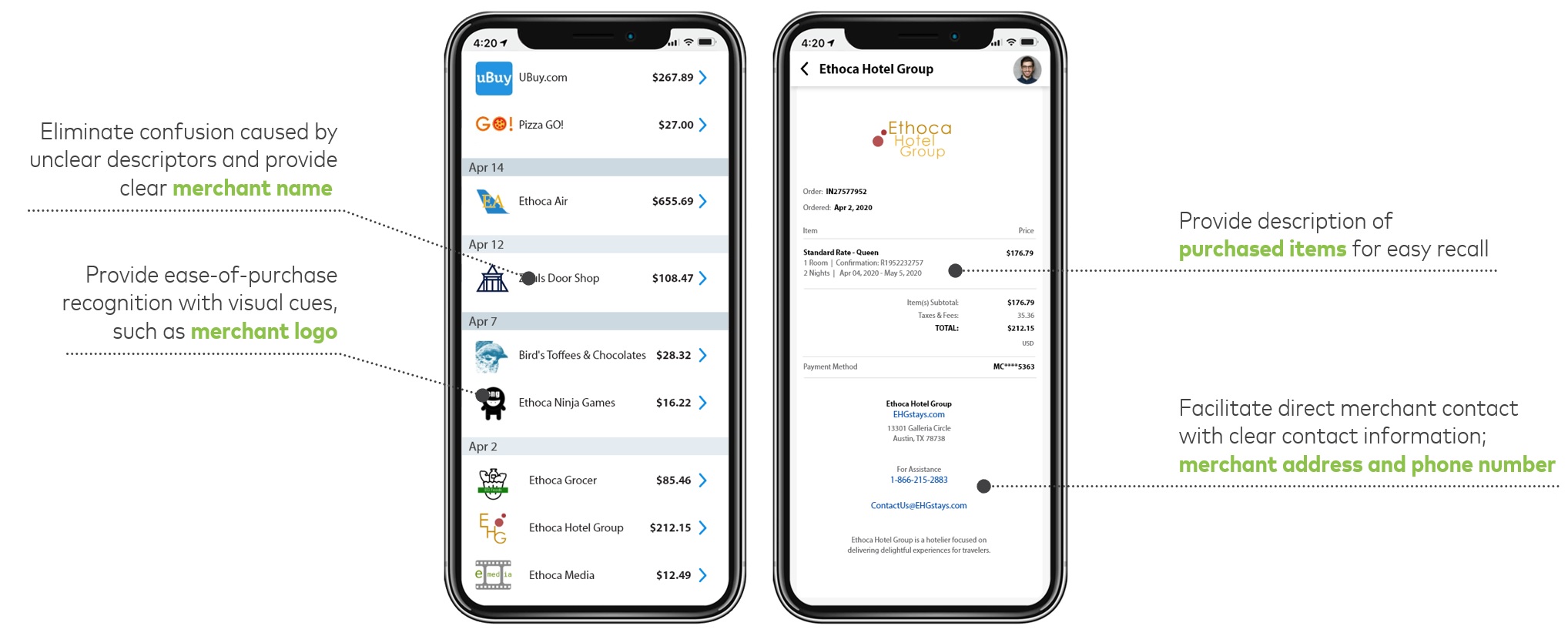

The collaborative work of Nets and Ethoca should overall make transactions more transparent by clearly displaying the name of the merchants, their logo or even by attaching digital receipts to each transaction.

-

This data will eventually be visible to end customers within their banking application to avoid any possible confusion about past transactions, thereby limiting chargeback requests.

CHALLENGES

-

Fighting a still strong threat: The new partnership between the two organisations has the same overall objective of fighting chargebacks, a major problem as merchants could lose nearly $130 billion in fraud by 2024 according to a Juniper Research study.

-

Improve customer experience: Chargeback procedures are estimated to be worth nearly $35 billion worldwide in 2021 alone. Over 96% of customers want more information about their transactions presented within their banking application.

MARKET PERSPECTIVE

-

MasterCard acquired Ethoca in March 2019 to help merchant customers quickly identify and resolve e-commerce fraud.

-

The US scheme also acquired Nets' instant payments division for $2.8 billion in August 2019.

-

MasterCard is not the only scheme involved in this battle, as Visa also announced in 2019 that it had acquired Verifi, a US company specialising in technologies for resolving payment disputes.