Memo bank simplifies the management of business expenses

The neo-bank dedicated to professionals, Memo Bank, is presenting a new service designed to further enhance its support for professionals. This new offer aims to simplify the management of professional expenses by relying on two very trendy and complementary services: deferred payment and configurable payment cards, integrated within a centralised expense management platform.

FACTS

-

Memo Bank announces the launch of a new expense management service for businesses.

-

Memo Bank has also selected Enfuce as its card issuing service provider. Through this partnership, Memo Bank can offer its customers Visa Corporate deferred debit cards.

-

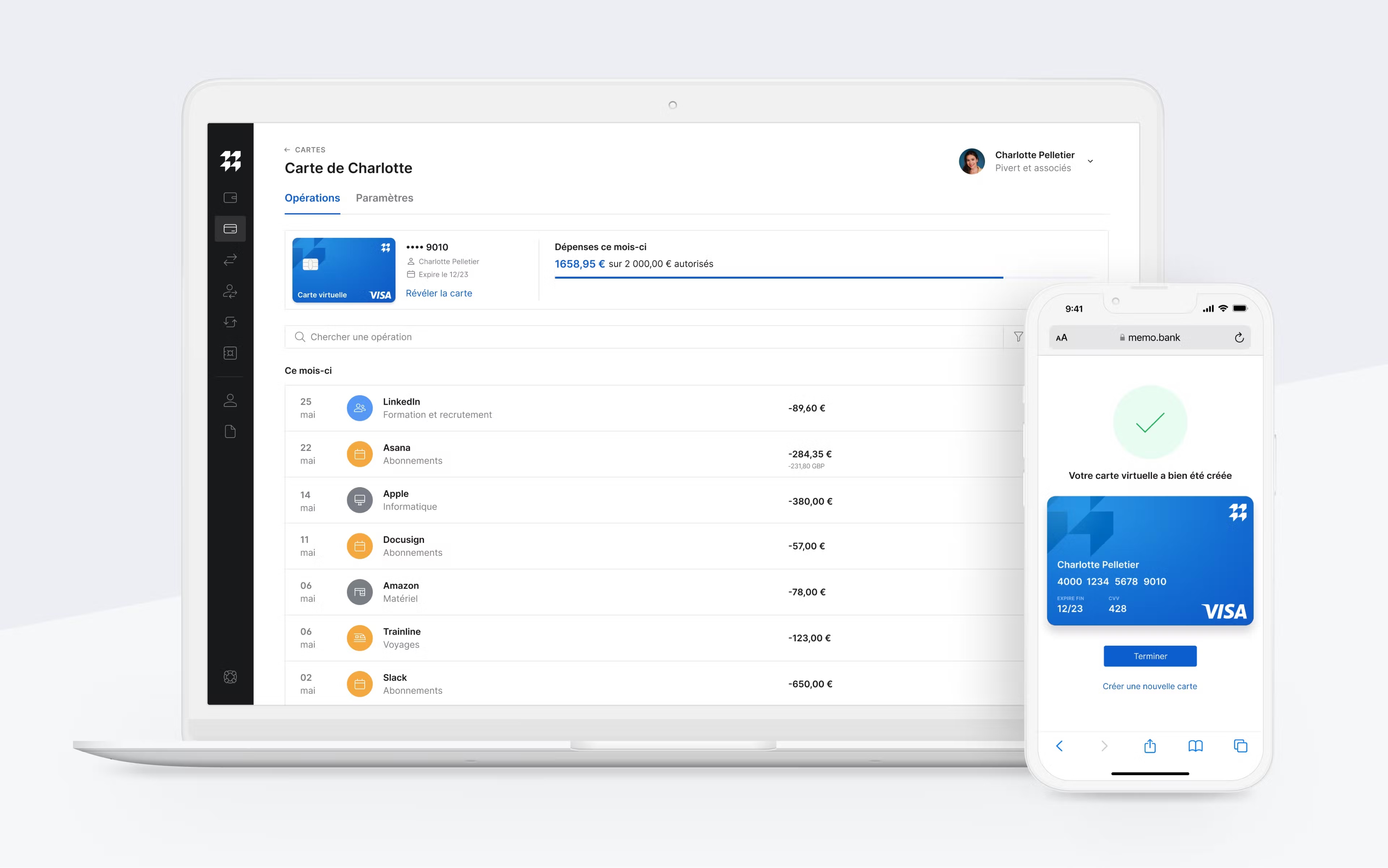

These cards can take several forms, physical or virtual. They are directly linked to the company's account and can be set up to be used by different employees.

-

Users of these cards can make purchases on behalf of the company via deferred payments. All Memo Bank payment card transactions are then debited on the first day of the following month.

-

Jean-Daniel Guyot, co-founder and CEO of Memo Bank, underlines the ambition of his service to offer a similar service to that of BNPL.

CHALLENGES

-

A cash flow optimisation tool: The total amount of deferred debit can reach a maximum of 50,000 euros per month for each company using the new Memo Bank and Visa service. It is thus presented as an alternative between BNPL and cash advances.

-

Take advantage of Visa's network: By partnering with Visa, Memo Bank is leveraging a global acceptance network for "its" new cards. Its service allows customers to make deferred payments at over 80 million merchant locations in more than 200 countries and territories.

-

Facilitating accounting work: The service promises to be highly responsive. Issuing a card to an employee is as simple as sending an email. Virtual cards are made available and can be used instantly. Spending limits and authorisations can be set in advance. Each transaction is visible in real time. The flows are well isolated by payment card. Each card can be linked to a different current account on the fly.

MARKET PERSPECTIVE

-

The digitalisation of the B2B market is accelerating rapidly. Today, small and medium-sized businesses expect to receive the same level of service as private individuals when it comes to payments.

-

Several startups in France and Europe have taken the plunge and are offering payment facilities to SMEs based on the same model as BNPL, including Alma, Defacto and Topi in Germany.

-

Virtual cards are also very popular in the B2B market. Players such as Stampli in the United States and Qonto in France offer configurable payment cards to simplify the payment of employee expenses. Memo goes a step further by integrating the issuing of these cards into a centralised expense management platform.