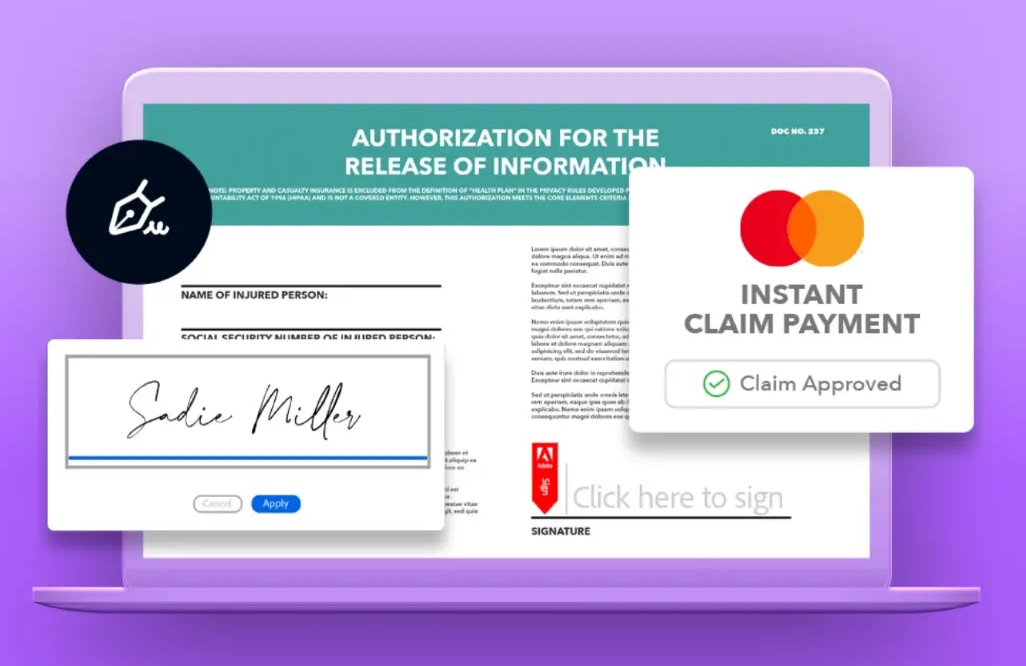

MasterCard and Adobe turn signatures into payments

Adobe has announced a new partnership with MasterCard. Their partnership will result in the launch of a new accelerated digital payment solution, validating the release of funds through the signing of administrative documents. A small revolution that illustrates once again that payment is becoming an automated service within more complex processes.

FACTS

-

Adobe has announced the launch of an integrated solution combining electronic signatures via Adobe Sign with instant payments via Mastercard Send.

-

The new partnership between Adobe and MasterCard helps to automate an entire process:

-

creation of secure online forms,

-

identity verification,

-

automated routing of documents for approvals,

-

electronic signatures,

-

instant payments.

-

-

The system is suitable for BtoBtoC use, offering a particularly effective solution for handling insurance claims, medical reimbursements, school fees, and the release of government financial aid, among other uses.

-

Customer journey:

-

Consumers are encouraged to use Adobe Sign to verify their identity, fill out their personal information (related to their application for aid or reimbursement) and sign their documents electronically.

-

Adobe securely collects this information before the companies requesting the credentials sent to consumers can approve the payments in a way that is still 100% digital.

-

After approval, Mastercard initiates payments almost instantly by transferring funds to eligible debit cards via Mastercard Send.

-

CHALLENGES

-

An integrated end-to-end solution: Adobe is working to develop seamless and secure paperless workflows. The integrated Adobe Sign and Mastercard Send solution enables a secure end-to-end communication and payment engine that can be easily integrated into any existing claims management system using Adobe Sign's extensible APIs.

-

Streamline processes: The linkage of Adobe Sign and MasterCard Send holds the promise of automating the disbursement processes for cumbersome administrative transactions. The validation of documents and their signature directly triggers the payment process and eliminates many steps (e.g. transfer of information between the decision-making departments and accounting) that currently slow down systems.

-

Disrupting archaic models: Processing printed cheques can take 7-10 days in some organisations. MasterCard and Adobe's shared service promises real-time payment validation.

-

Addressing insurance market issues: Adobe and MasterCard emphasise the adaptability of their service to the needs of insurers and their policyholders. In this market, the release of financial aid is often urgent. The volumes are commensurate with the stakes, since policyholders spend some 2.4 billion dollars on insurance premiums each year worldwide.

MARKET PERSPECTIVE

-

The digital transformation of financial services is blurring the line between payment methods and IT systems where the validation of one action can automatically trigger other actions.

-

As with one-click payment, Adobe and MasterCard are presenting a new model for automating payments in a comprehensive process. Adobe is also working with one-click payment provider Bolt to facilitate payments.

-

The launch of this new joint service by MasterCard and Adobe is yet another example of the strong trend towards bringing identity (and in this case document signing in particular) closer to payment.