M-commerce: Klarna Further Focuses on BtoC Offers

The Swedish FinTech reported record growth figures as 2018 began and is now aiming for another segment of the value chain via addressing end customers, too. Klarna is expanding their set of offers with a PFM-dedicated mobile app for the general public.

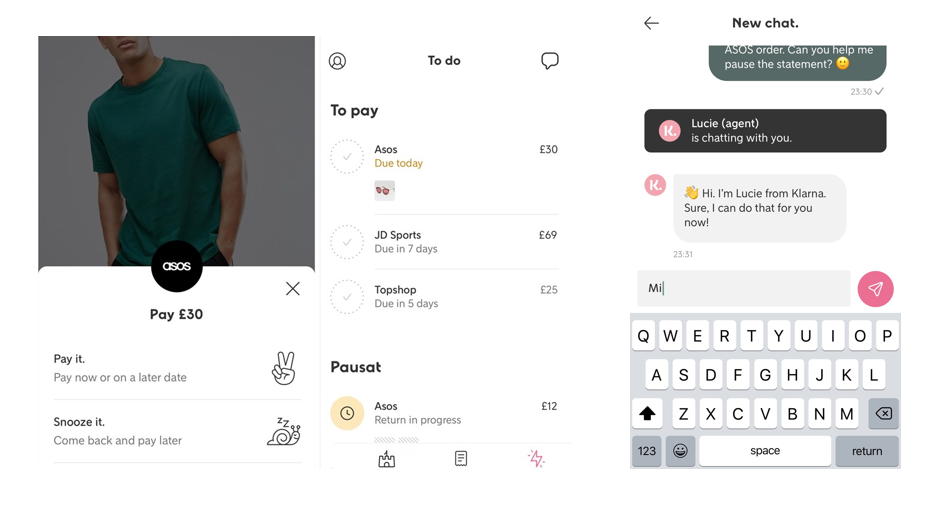

Klarna initially built on the e-payment sector to grow and made a name for itself on this sector. They have been granted a European banking licence enabling them to rethink their brand image and further focus on consumers’ expectations. Their new app, called “Smoooth”, is first meant for their existing merchants’ customers –already using their e-payment solution– but not only.

It will allow customers to manage their payments and benefit from commercial offers. They may then keep an eye on all transactions initiated using Klarna, choose their payment method (pay now, pay later or spread their installed payment), pause or trigger their payments, track their orders, or even handle products’ exchange or return via a chabot. The users may also stay informed of the latest offers through an Instagram-like interface.

This solution should soon be enhanced with a companion (credit/debit) payment card. The app is available in Northern and mainland Europe for now, but its expansion to the UK and US should be scheduled this summer.

Comments – A single desk for e-purchase(r)s

The m-commerce sector is expanding fast: mobile-based e-commerce, in-store interactions, in-app purchases… many sub-sectors are impacted. Consumers are increasingly familiar with using mobile devices on a day-to-day basis… and Klarna understood this very well. As customers tend to view pages on mobile more often than on their desktop PC, it comes as no surprise that mobile media should be considered a strategic priority by this FinTech. This explains why they are focusing on user experience and especially stressing mobile users’ expectations.

Klarna’s new positioning as a platform for services is meant to streamline and enhance merchant-customer interactions, and assert loyalty on both sides. They are then addressing purchasers directly, aiming to help them manage all transactions, be they processed via Klarna, or not. This evolution should become possible as the PSD2 keeps being implemented and Open Banking APIs are starting to emerge.

Klarna will also be issuing their own credit card as a logical addition to their new app. They are materialising the vision they set forth when they were granted their banking licence (mid-2017). Resulting ambitions had already been highlighted by the launch of a credit transfer-based P2P payment app called Wavy in August 2017.

Also: https://itunes.apple.com/de/app/id1115120118?l=de&mt=8