KBC Introduces Matti, a Smart Investment Bot

FACTS

- The Belgian institution KBC unveils Matti, their smart investment assistant.

- This bot designed by Bolero (KBC’s online platform) is meant for their customers as well as for non-customers.

- The users provide information regarding their personal situation, fill out a 15-minute questionnaire and specify up to 4 preferences so the bot may define their appetite for risk and return and their knowledge on Exchange-Traded Funds.

- They are then sent e-mails featuring management advice and recommendations. They may choose to take this advice (or not) throughout the lifespan of their portfolio.

Key Figures

- Tests started 6 months ago

- 50 ETFs

- 9 customisable portfolio profiles

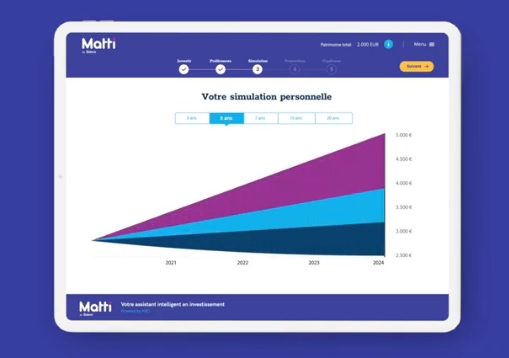

- Portfolio starting from €1,000

- Annual all-in service fee of 1% (excl. VAT) on the invested amount

- Matti doesn't charge custody fees or transaction costs

CHALLENGES

- Valuing algorithms. Matti has been crafted by KBC’s algorithmics specialists and experts. It also relies on Nobel laureate Harry Markowitz’s Modern Portfolio Theory.

- Increasing investments’ popularity. Based on experts' skills as well as on an automated and accessible service, KBC intends to provide the general public with the means to invest in the stock market.

- Customising investments. Matti lets the users specify their preferred asset classes, the geographical areas where they intend to invest and business sectors they favour. Investors then have a say in the ETFs to be included in their portfolio.

“6 out of 10 Belgians indicate that they would like to invest if it were less complex

and if they could get a clearer picture of the returns in both good and bad times.”Source: iVOX survey for Bolero, 2019

MARKET PERSPECTIVE

- Several institutions committed to democratising trading. FinTechs were the first to start focusing on this sector. Dedicated services were introduced as early as in 2016 in the US, as highlighted by Robinhood’s app. In 2018, Revolut aimed for the same goal in Europe.

- Since then, more launches have been announced: Birdee, Nalo and WeSave, for instance. KBC stands out with a conversational interface and pays attention to customising their bot, Matti. The Belgian bank also makes Matti available to their customers as well as to non-customers: an open approach they already implemented when focusing on mobility-related services, and which tends to be gaining ground in Belgium.