KBC Adds Non-Banking In-App Services

Banking players keep focusing on diversifying their offers. KBC, for instance, chooses to add one-of-a-kind services in their banking app, with even nothing to do with their banking activity. In France, Crédit Mutuel made a similar announcement and considers selling old real estate properties.

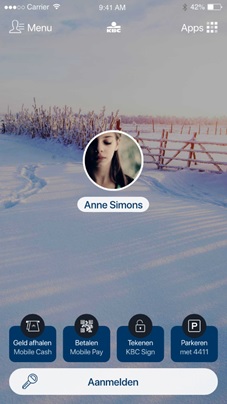

The Dutch bank KBC has added two non-banking services to their m-banking app: Parking 4411, for car parking payments, and Monizze (issuer of paperless meal vouchers) allowing customers to track their card-based luncheon voucher transactions.

In both cases, the user’s profile will have to be linked to the m-banking app. They will not require that the user should upload an additional app.

Through using Parking 4411, customers can specify when their car parking time starts from the m-banking app. He gets a notification 15 minutes before the purchased amount of time expires. And, with Monizze, the user may check his prepaid card balance, as well as display his recent transactions.

Comments – Open-banking : Upheaval in the financial sector

It seems already that 2018 will be witnessing the take-off of multiservice marketplaces, in the wake of the PSD2 implementation. In this context, long-standing banking players have to make sure they take part in this game, and they can build on their status of trusted service provider to stand out.

KBC for their part has been focusing on proposing day-to-day services in the past, branching out from the sole banking sector. In 2016, they unveiled the Happy@home platform, enabling some of their customers to subscribe services from their home. With this initiative, they are hoping to encourage mobile uses through given their customers even more reasons to open their app (910,000 people already use their app nearly every day, and roughly 24 million connections are recorded each month).

The inspiring model of instant messaging services

KBC draws inspiration from WeChat’s model for this launch. The instant messaging service does include all sorts of services, helping them keep their customers using their app. KBC’s new app would be planning to rely on a similar principle.

This launch is also in line with the current Open Banking trend: in fact, the new services they included have been crafted by partner companies.