Instant Payment: Transactis Aims for Banks

Tansactis –joint subsidiary of Société Générale and La Banque Postale– payment factory for processing their flows is launching an instant payment service aimed at French and European financial institutions. This Joint-Venture will rely on this expertise to also process card payments for banks, as they are only getting started with implementing Instant Payment.

Since many French and European banks haven’t invested in high-availability, real-time technology to process huge volumes of transactions, Transactis developed a multi-bank platform for handling payments.

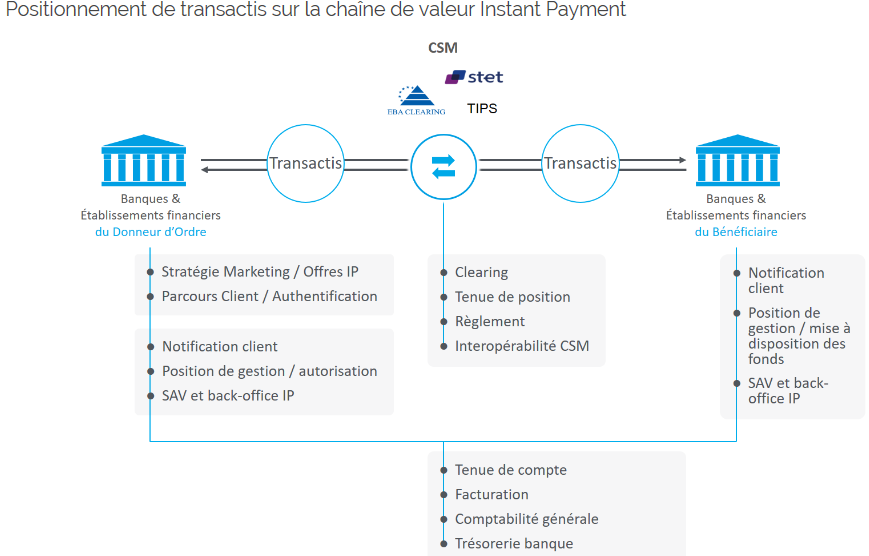

This platform has been designed to easily include new customers, and proposes two types of offers. First: full monitoring and processing of instant credit transfers to clearing systems, through direct interfacing with banking apps (API or Web Service). Second: for interbank exchanges only, providing instant access to different European clearing systems (EBA Clearing, ECB or STET).

Transactis has been crafted in partnership with Sopra Banking Software. It will first be made available to their networks and shareholders, i.e.: Société Générale, Boursorama, Crédit du Nord and La Banque Postale. And Transactis hopes to attract other banking institutions in the near future.

Comments – Instant Payment as a tool for conquest for Transactis

Through the implementation of pan-European Instant Payment, the issue for banks is to build high-availability Information Systems able to process huge volumes and ensuring real-time operations. For some banks, this means actual architectural changes, as well as heavy IT investments. Transactis then proposes a mutualised offer. This vision is, however, contradicted by the operation of similar payment factories for BPCE and BNP (Partecis) and Crédit Agricole Payment Services.

Then, Transactis hopes they will attract other institutions and be entrusted management of their electronic payment flows, with centralisation and cost efficiency in mind. To achieve this, they rely on a wide array of functions and attractive costs. Yet, this market remains quite “unclear” yet still considered strategic. BPCE claimed they would be ready to receive and send instant payments by 24 April, Crédit Mutuel Arkéa intends to be ready by July, and BNP Paribas could make an announcement in November. Real-time payments are becoming a reality in France, even if some questions remain unsolved, including costs and use cases.