Hello Bank! Offer Renewed with Paid Service

FACTS

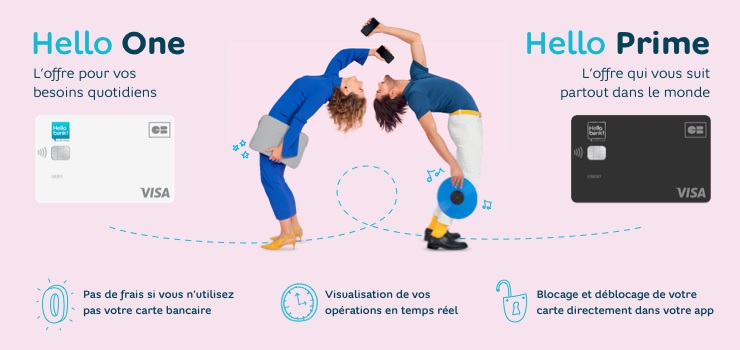

- Hello Bank! will soon be launching two new banking offers. Their goal: further diversify their set of services and focus on an affinity-based approach.

- Hello Bank! intends to stand out as a mobile bank for Millennials and globetrotters. In order to meet young customers’ expectations (20-35), they are introducing two dedicated offers.

- Hello One:

- Free entry-level offer (no minimum income required),

- Card applying balance checks for each transaction and instant debits,

- Cash withdrawals for free at ATMs from BNP Paribas and their subsidiaries worldwide,

- Fee-free payments when abroad,

- Real-time, in-app monitoring service (activation/deactivation, contactless payments, e-payments).

- Hello Prime:

- Paid offer: €5 per month; minimum income required (€1,000 / month),

- Card applying balance checks for each transaction, instant or deferred debits,

- Customised overdrafts,

- Payments and cash withdrawals for free when abroad,

- Advantages and insurance offers from Visa Premier,

- Instant credit transfers for free,

- Real-time monitoring service (as with Hello One),

- Privilege access to advisors from the Hello Team.

- Customers may shift from one to the other offer at any point.

Key Figures

- 500,000 customers claimed in November 2019

- 520,000 customers to date

- Goal: 1M customers by end-2022

- Profit expected by 2022

- Planned launch date for these offers: 20 January 2020

CHALLENGES

- Simplifying their offer and testing a freemium business model. With Hello One, Hello Bank! features a simple offer highlighting their commitment to helping young customers monitor their budget. For the first time, they also launch a paid offer, along with features and services for globetrotters. This (paid) freemium offer provides customers with access to an advisor. The point for Hello Bank! would be to break even in 2022.

- Stressing their identity. This strategic repositioning might help Hello Bank! stand out within BNP Paribas’s environment. Compared to Nickel, for instance, Hello Bank! stresses a complementary and more affinity-centred approach.

- Meeting customers’ expectations. This choice by Hello Bank! results from coworking processes involving their customers and takes into account customers’ interest in full-mobile offers and real-time transactions.

MARKET PERSPECTIVE

- Hello Bank! started reshaping their offer in October 2019. They fully relied on their mobile app when it came to design and ergonomics.

- These restructured services are meant to address issues faced by all alternative options from large-scale banking groups. BNP Paribas isn’t the only institution having had to reconsider their model: Boursorama, ING, Fortuneo also had to go through this process over the past months.

- In order for Hello Bank! to keep growing, they may end up featuring services for kids, as well as for self-employed workers, while also crafting new affinity-focused offers.