French Customers Praising a Responsible Approach to Consumer Credit

More than 25% of the French households have subscribed a consumer credit line and the proportion of new borrowers has increased by roughly 3% in 2017. Their interest in applying for such loans may be accounted for by improvements in the economic context and overall state of mind among the French population over the past years. Levels of over-indebtedness have decreased: consumer credit came to be seen as a tool for achieving major projects, yet in a responsible way encouraged by provisions of the Lagarde Law.

Cofidis France and the CSA Research Institute conducted a survey on borrowers’ profiles, use cases, and reasons for subscribing a consumer credit. The average amount of these credit lines reaches 8,585 euros.

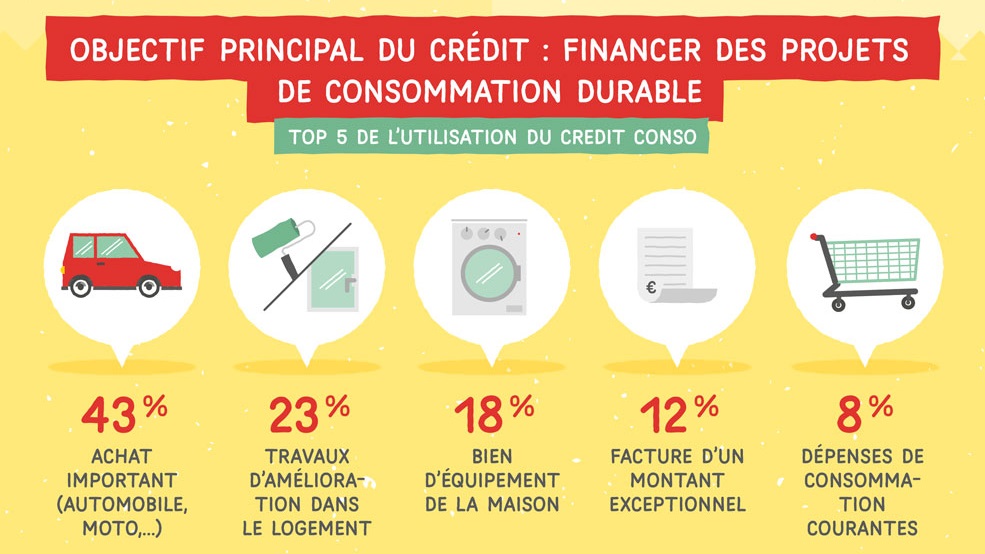

In their assessments, consumers mostly apply for a credit when having to finance long-term projects (major purchases: a car for 43% of the respondents) or to improve their life conditions. Yet, credit lines remain a means to deal with unforeseeable events for one fourth of the borrowers: this proportion keeps decreasing. Personal loans and loans for specific projects are still selected by French households (respectively: 44% and 43%), followed by revolving credits (29%).

Five types of borrowers’ profiles have been identified in this survey: 1) customers who purchase items they loved at first sight and enjoy a comfortable standard of living (31%); 2) more rational customers financing major, well thought through projects (22%); 3) customers facing financial difficulties (18 %); 4) opportunists, on the lookout for good bargains (17%); 5) instinctive customers fond of change (12%). All in all, these indicators tend to show that French people still are interested in consumer credit offers yet use them in a more responsible manner.

Comments – Motivation for most financial players

The idea of applying for a consumer line seems to have become trivial among French households. This survey by Cofidis and CSA Research shows that consumer credit is not considered by just one social category or customers facing tight financial situation. It then conveys a rather uninhibited, or at least favourable, image. Changes in the way customers see things can be accounted for by economic improvements which translated into lower levels of over-indebtedness (-6.7% fewer files between 2016 and 2017, according to the Banque de France).

Yet another impacting trend: dematerialised subscription processes have been gaining ground (1 in 3 people among those surveyed subscribed online). Banks (La Banque Postale, Orange Bank) and FinTechs (N26, Younited Credit, FinFrog) have understood this very well and implemented online or mobile services enabling people to apply for personal loans, along with simpler, faster customer processes.