FinTech Zeal wants to personalize payroll management

Zeal is an American FinTech born in 2019 in San Francisco. Its youth does not prevent it from aiming at high ambitions, such as renewing payroll management in the United States. To do so, it has just raised funds.

FACTS

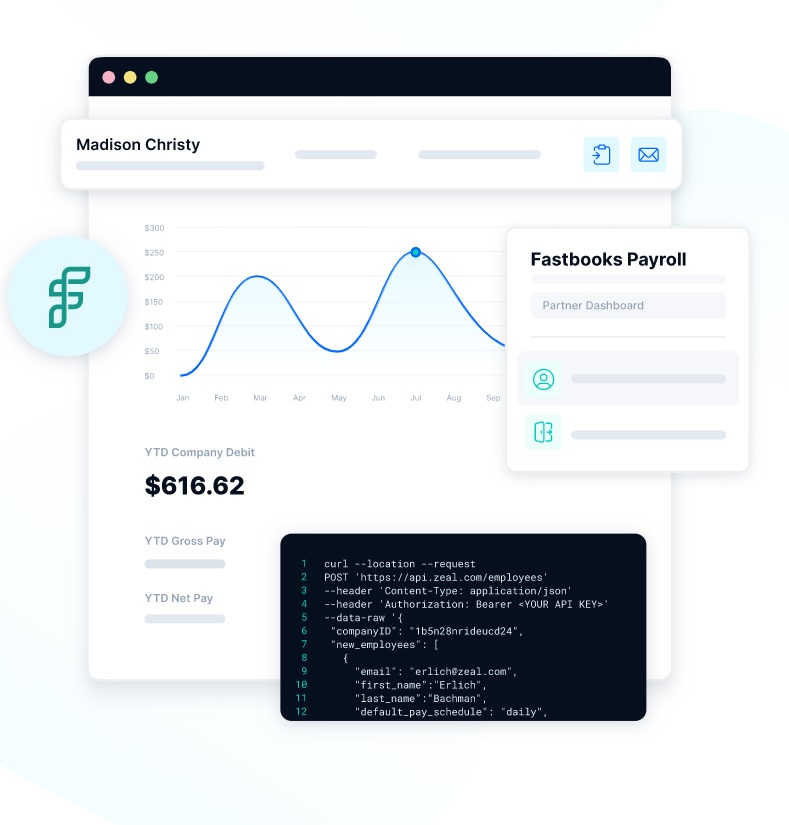

- Zeal has just closed its first Series A round of financing for $13 million. The opportunity to present its API infrastructure whose objective is to help companies create their own payroll management systems.

- The FinTech is targeting SaaS platforms as well as live employers to customize their payroll management tools as much as possible through APIs.

- It designs unique payroll management tools adapted to the needs of each, allowing companies to pay their employees on a daily basis, for example.

- In addition, it takes care of adapting payroll to governmental, fiscal, and legal changes in near real time.

- Zeal's client companies keep their data in-house and simply rely on Zeal's APIs to facilitate their management.

CHALLENGES

- Overcome an obsolete tool: Zeal criticizes the big names in the payroll management market, such as ADP or Paycor, whose standardized offers do not meet the specific needs of all companies.

- Addressing a major issue: More than $8.8 trillion in payroll is processed each year in the United States. Zeal also highlights the fact that 11,000 U.S. tax jurisdictions produce more than 25,000 income tax code changes per year. In this ever-changing environment, 40 percent of small and medium-sized businesses pay at least one payroll penalty per year for failing to adjust their payrolls on time. Zeal adds its expertise in payroll legislation to justify the optimized and responsive nature of its service.

- A promising tool: Zeal's innovative promise has already attracted the interest of key FinTech players. In addition to its institutional investors, Spark Capital and Commerce Ventures, the CEO of Marqeta and the founder of Robinhood also wanted to participate in its first round of financing.

MARKET PERSPECTIVE

- Zeal's commitment to evolving the payroll management market addresses a fundamental issue that several FinTechs have already sought to address with their solutions.

- PayFlow, Typs, Even, Activehours and more recently Revolut are all solutions that aim to bypass the restrictions of payroll management and offer more flexibility to companies and their employees.

- Zeal takes the problem from another angle by addressing companies not to offer a service to their employees individually, but by opening up new possibilities for global payroll management.