Feedback: N26 takes stock of digital bank customers

N26 has partnered with Accenture to conduct a comprehensive study on consumer expectations of digital banking. The study takes stock of the factors that have enabled the significant growth in digital banking since the start of the health crisis, but also of the opportunities and the potential for further growth.

FACTS

-

N26 and Accenture conducted a joint study to better understand consumers' habits and expectations of digital banks.

-

The study surveyed over 47,000 digital and traditional bank customers across 28 markets.

-

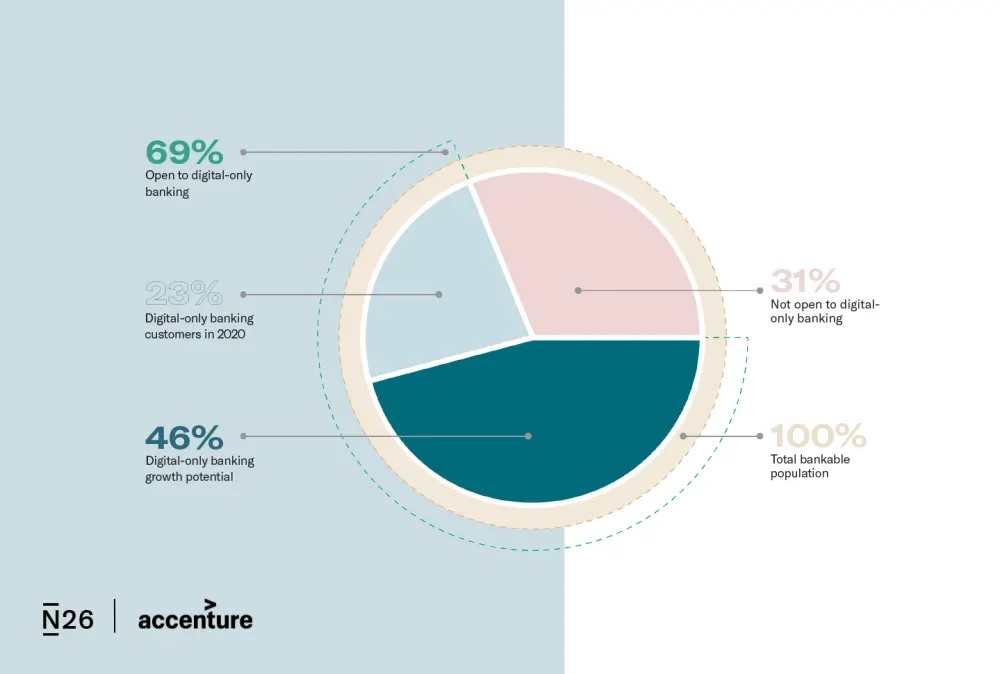

The number of consumers with an online bank account now represents 23% of the population, or around 450 million customers.

-

But the potential for growth is still strong. Overall, 69% of respondents are open to the benefits of 100% online banking according to the survey. The main drivers of digital banking adoption are

-

an optimised experience that is simple, convenient and fully accessible from a mobile device

-

Clear communication,

-

competitive pricing.

-

-

However, traditional bank customers point to two main reasons for not having an account with an online bank:

-

47% are satisfied with the services of their traditional bank,

-

42% are not familiar with the offerings of online banks.

-

-

In terms of geographical disparities, Saudi Arabia, the United Arab Emirates, Brazil and China have the largest share of the population already converted to 100% digital banking. But the take-up in Western Europe is accelerating, particularly in Spain, Germany, Belgium, Italy and the Netherlands.

CHALLENGES

-

A trend exacerbated by the COVID-19 pandemic: This new study underlines, if it were necessary, the fact that the pandemic has acted as a driver of the digital transition, including in terms of banking habits. N26 estimates, via its market research, that the number of online banking customers could reach 70% of the population of the 28 countries analysed, i.e. 1.4 billion potential customers.

-

Acquisition levers: In digital banking, trust in the financial institution is essential. Although 35% of the banked population in Europe say that the typical features of digital banks would not motivate them to open a digital-only bank account, 65% could still be converted to digital banks because of their clear value proposition.

-

Geographically dispersed opportunities: Between 2018 and 2020, the adoption rate of online banking services has doubled in Switzerland, Brazil, Ireland, the UK and France. Accenture and N26 expect the market to be particularly strong in China and the US over the next few years, with 771 million and 148 million customers respectively.

-

Women could be the next wave for digital banks: While in the early years of digital banking, customers tended to be men and high earners, this is changing. Another notable trend is the change in the age of digital banking users. Often seen as a service for the younger generation, digital banking in Europe is also taking off among middle-aged customers.

MARKET PERSPECTIVE

-

N26's news has been marked by contrasting developments in recent months. The neo-bank is facing the mistrust of the German financial supervisory body BaFin, which reproaches it for the weakness of its anti-money laundering controls. A decision that led to the decision for the neo-bank to leave the US territory in November to officially refocus on its European activities.

-

A hard blow that did not prevent N26 from keeping the confidence of investors and raising a historic Series E round of funding last October.

-

N26 nevertheless remains the second largest neo-bank in Europe after Revolut. And while it respects FinTech practices by remaining discreet about its results, it nevertheless specifies that its break-even point should be reached in 2023. It also plans to carry out an IPO, which will require it to publish its results and be more transparent.