Feedback: Adyen at the crossroads

In the waltz of announcements of the 2022 financial results of the major banking and financial players, Adyen surprised the markets, which sanctioned the share with a sharp fall, despite its strong growth in results. This singularity is also illustrated in the strategy of the player, which is at odds with its competitors. This risk-taking is enough to make investors doubtful, but it could also prove to be the cornerstone of its differentiation and success.

FACTS

-

While many of its competitors have been hit by the economic uncertainty of 2022, Adyen has posted rather flattering financial results:

-

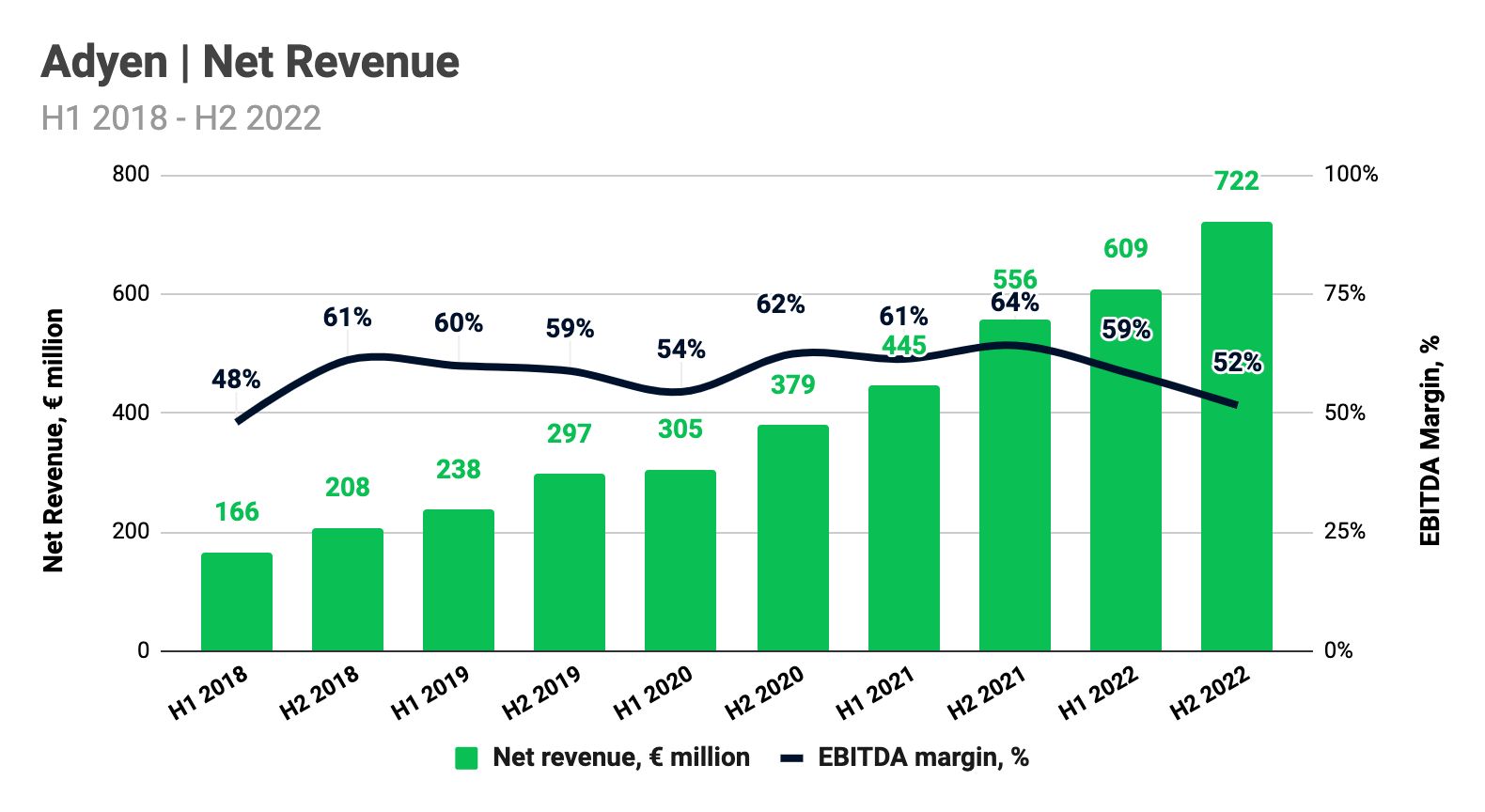

revenues up +30% (to €722 million)

-

net annual profit up 33% (to '1.3 billion)

-

Transaction volumes up nearly 50% (to '767 billion)

-

an operating margin of 52% (compared to 59% last year)

-

-

It is on this last point that investors punished the share, whose price fell by 16% on the publication of these results. Indeed, with an ebitda of 372 million euros (+4% in one year), Adyen is well below the profitability expected by analysts (445 million euros).

CHALLENGES

-

A long-term strategy, against the grain of its competitors: among others, PayPal and Stripe have announced massive layoffs at the end of 2022 and the beginning of 2023, with the undisguised ambition of preserving this profitability which is a decisive indicator for investors. Adyen, for its part, has chosen to recruit 757 people in the second half of 2022, bringing the workforce to a total of 3,300, and plans to hire another 1,200 in 2023; an investment strategy that can only weigh further on its profitability. This choice can be explained in part by the difficulty that the group has encountered in recruiting new employees in 2020 and 2021; it would therefore be a matter of catching up now, while the tension on the job market is gradually diminishing.

-

Internalising the creation of a unified commerce platform to attract the largest merchants. Here again, Adyen distinguishes itself from its competitors by not acquiring technologies, but by developing all its solutions itself. As a result, the company is now at the head of an extremely integrated platform, which enables it to offer a very wide range of financial solutions to its customers: online payment, in-store payment (via its own SoftPOS), and financing to merchants (via its Revenue Based Financing offer). This strategy has paid off, as it has enabled Adyen to attract leading merchants, some of whom were initially equipped by banks: General Motors, Monoprix, Toys'R'Us, Spotify, Uber, Booking.com, Microsoft, H&M, etc.

MARKET PERSPECTIVE

-

In terms of transaction volumes processed, Adyen is now one of the top 10 European acquirers, alongside players such as nexi, Worldline and Barclay's, reshuffling the deck between the major banking acquirers and new entrants.

-

In the unified commerce segment, which is currently the hobbyhorse of major merchants, BNP Paribas is seeking to push its Axepta Unified offering.

-

Compared to Adyen, PayPal reported better-than-expected results, but these show a steady slowdown in the number of transactions.