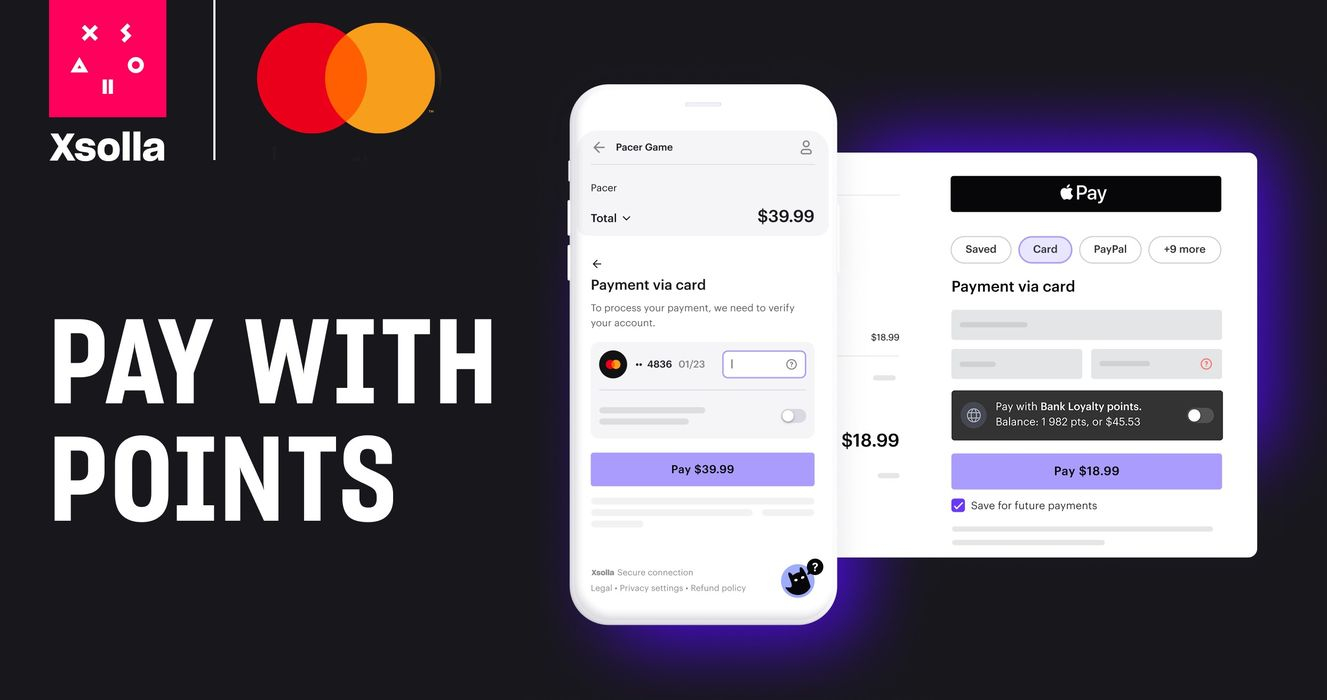

Mastercard and Xsolla aim to smooth the payment experience for gamers

Mastercard and gaming commerce company Xsolla have teamed up to collaborate on payments for gamers. The two companies said they want to create smooth, secure and rewarding payments for players to provide enhanced payment experiences using loyalty points linked to card payments, gifts, in-game bonuses, as well as improved payment processes for creators.

FACTS

-

Mastercard and Xsolla will work together to enable innovative card and account-based solutions and services to enhance digital experiences in payments and beyond for gamers.

-

To kick off this groundbreaking partnership, for the first time, Mastercard cardholders will be able to use Pay with Points to seamlessly redeem their loyalty points for in-game purchases - this solution will be integrated with Xsolla's Pay Station product.

-

Players will be able to redeem loyalty points from participating Mastercard partners for in-game purchases later this year.

-

Xsolla and Mastercard will showcase the Pay with Points solution at the Game Developers Conference 2023 in San Francisco on March 21-24, 2023.

CHALLENGES

-

Games as an ecosystem of innovation: with nearly 3.2 billion players, the video game industry attracts many economic players and offers many opportunities for payment players. There are several monetisation models that developers and publishers use to increase their profits: Pay-per-download (premium), DRM licensing, Free2Play (freemium) and in-app game monetisation that allows access to the game or users to purchase additional digital goods. By combining Xsolla's payment solution with Mastercard's loyalty capabilities, cyber solutions and card and account payment technology, the two players aim to establish themselves as a major player in a market that is still rather fragmented.

-

Making payments smooth and secure: The two imperatives that crystallise payments in the video game industry are to make them more fluid to allow, in particular, micro-payments that are inserted as part of the game itself. The other is to make them secure. On the one hand, because video games are mostly played by young people, who are more sensitive to fraud attempts. In particular by using Mastercard's authentication and fraud detection capabilities to give parents control before their child makes in-game purchases. And secondly, because these payments are mainly made online and in this context, video game publishers are a very attractive target for fraudsters and the theft of sensitive data.

MARKET PERSPECTIVE

-

In its latest barometer, BPCE shows a 43% increase in spending on video games, with a ratio of 99% made via online payments. And in a recent study, Visa points out the importance of an integrated payment experience so as not to disrupt the player's gaming experience.

-

Games are not the only ones to investigate the subject of micro-payments. Social networking platforms are also using them to enable the payment of content and content creators.

-

Discord is an online communication platform used by millions of users around the world. Discord has recently added a new payment method called micropayment. This payment method is designed to allow you to pay small amounts of money for additional features on Discord.

-

The most emblematic change is to the social network Twitter. As part of his transformation of Twitter, Elon Musk wants the platform to have a payment feature. The microblogging network has started the process of obtaining the necessary regulatory licenses in the US.