Digital Euro aims to be a simple currency

The European Central Bank has unveiled its vision for its future central bank digital currency. The institution talks about a consumer application capable of "offering contactless payments or QR codes".

FACTS

-

The ECB seems to have finally made up its mind: the future digital euro will never be a "programmable currency", says ECB Executive Board member Fabio Panetta.

-

The ECB wants the digital euro to be inclusive, so it is working on a simple-to-use "new digital application" for payments made through bank intermediaries.

-

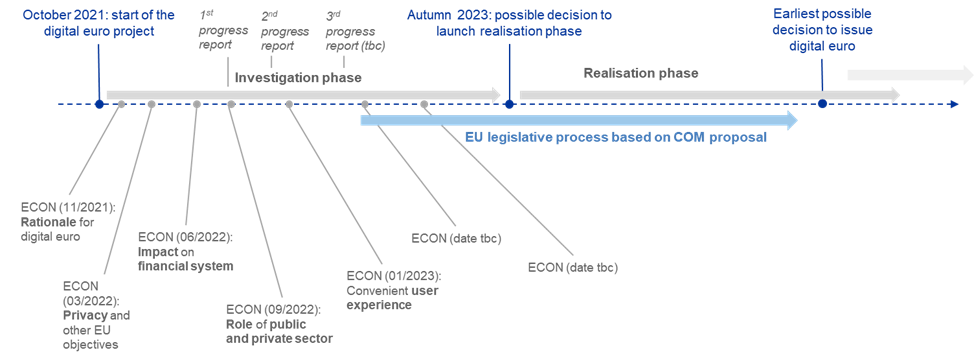

The ECB Governing Council will decide in the autumn whether or not to move to the pilot phase of implementing the digital euro. The ECB's decision on whether to issue a digital euro will be taken later, once the EU Parliament and Council have adopted its legislative framework.

CHALLENGES

-

Addressing the decline in the use of fiat currencies: The payment behaviour of individuals is changing at an unprecedented rate: over the last three years, the share of cash payments has fallen in the euro area from 72% to 59%, while digital payments have become increasingly popular. In the Netherlands and Finland, for example, cash is used in only one in five transactions.

-

A digital euro for all: The ECB wants to focus on ease of use to encourage take-up of the new euro: "It would complement cash and offer Europeans the possibility to make payments throughout the euro area, free of charge. Ease of access and use would be an element in favour of its adoption and financial inclusion.

-

Do not make the euro a financial instrument: "Let's be clear: the digital euro will never be a programmable currency," ECB Executive Board member Fabio Panetta told the European Parliament's Economic and Monetary Affairs Committee. This means that the ECB will not be able to impose restrictions on how this digital euro can be used, for any purchase, where and when.

-

Avoiding the issue of personal data: This fear remains very strong, because with the blockchain it is indeed possible to track all transactions made with a single currency unit. Even if the ECB wants to keep its eyes closed, it wants to be able to keep track of transactions in case of money laundering, terrorist financing or tax evasion.

MARKET PERSPECTIVE

-

The advent of central bank e-money would also give the European level "a strong lever to assert our sovereignty against private initiatives like Libra". The United States also wants to work with the Federal Reserve to maintain its global monetary leadership through the e-dollar project.

-

Moreover, this project will have to be linked to the EUDIW (Europen Union Digital Identity Wallet) project on which the European Commission is counting to relaunch the EPI project.

-

The ECB project seems to be competing with the Spanish Central Bank, which has just authorised a pilot project for a digital euro in partnership with the fintech Monei. It is also being challenged by the Spanish private banks, which last November launched an experiment to analyse the technical, operational and commercial implications of the digital euro and its coexistence with existing payment instruments.