Credit Karma makes cashback random and fun

FACTS

- Credit Karma is currently working on a model that reinvents loyalty programs based on random reimbursement for spending on its cards.RKET

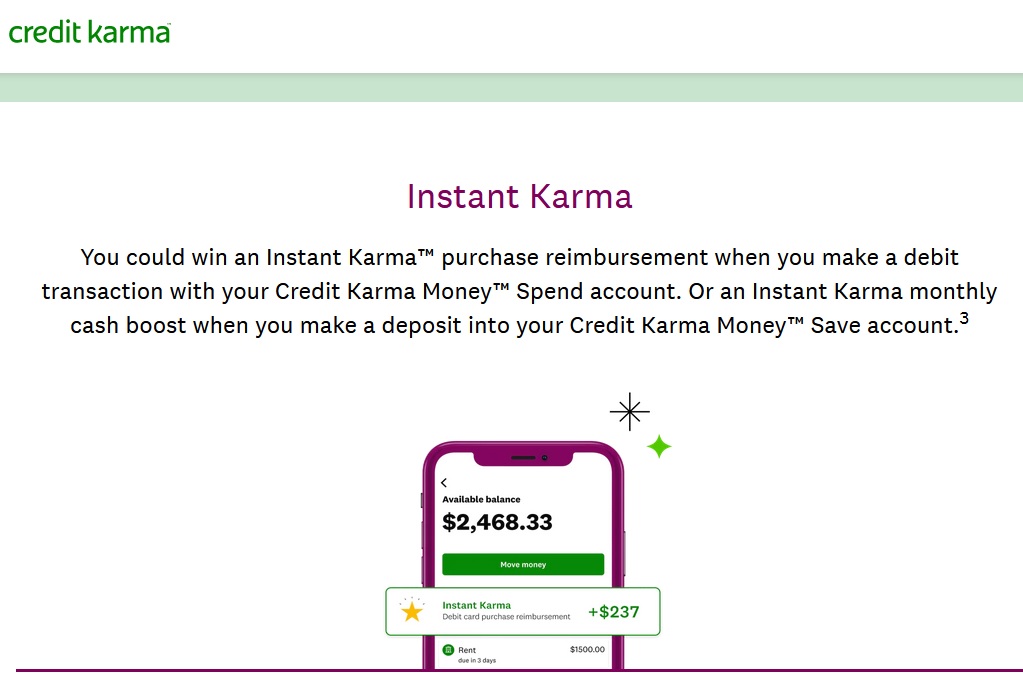

- The US based start-up, specialized in financial services for individuals, has been testing a new feature since February. Called Instant Karma, it is now officially launched.

- The idea behind this feature is to randomly reimburse purchases made by Credit Karma's customers rather than crediting a cash-back amount to each of them based on the amount of their purchases. The amount is instantly credited to the account of the beneficiary of this "draw".

- This feature is attached to the Credit Karma Money account (combining current account, credit card and savings) launched in 2020 and specifically targeting Millennials.

- Since the launch of the Instant Karma feature, Credit Karma says it has rewarded nearly 100,000 transactions, with a total value of $5 million.

CHALLENGES

- Renewing a classic offer: rather than refunding a portion of the purchases of all users of its services, Credit Karma prefers to apply the principle of the lottery to cash-back. A technique increasingly used by FinTechs to introduce a more playful notion within their offers. This is the principle on which Bella is based; with its Bella Surprise feature, the FinTech randomly refunds an amount of 5 to 200% of purchases made with its card.

- Attracting new users: the launch of this functionality linked to a debit card should help attract a new customer base, which has been reluctant to use a credit card until now. For business model reasons, it is mainly credit cards that allow cashback to be accumulated in the United States. Young people from genZ are particularly targeted by this offer.

MARKET PERSPECTIVE

- Afterfocusing extensively on the customer experience of their products, FinTechs are turning more and more to building customer loyalty, which now strongly mobilizes their capacity for innovation. Cash-back is presented in various forms: a savings tool, a personalization lever, a solution to support solidarity associations or even an investment tool in crypto-currencies.

- In China, the principle of lotteries is very popular and has contributed to the success of the payment super-app WeChat, which has applied it to a no less well-known practice of transfer between individuals, the "Hongbao". More recently, the Chinese government tried a similar experiment for the launch of its digital Yuan.