Credit Karma Assisting Home Owners

FACTS

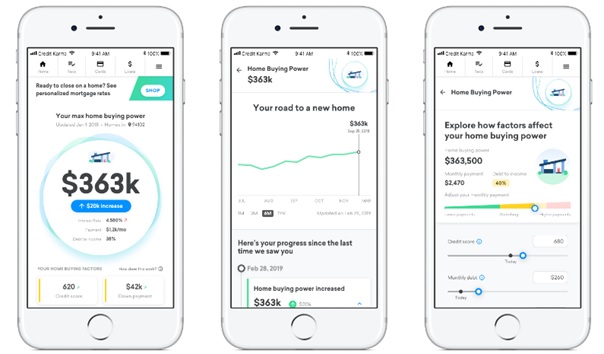

- The American FinTech Credit Karma already became a key PFM player, and just launched a new service called “Home Buying Power”.

- This new service is meant to help their members build realistic home buying projects.

- Home Buying Power provides explanation to its users: determining factors in achieving their project, how to implement these factors and how to improve their situation so it can be achieved.

- Credit Karma analyses the user’s credit score, income and savings to provide customised advice and assistance. This service also specifies their borrowing capacity and shows relevant mortgage options in real time.

CHALLENGES

- Improving access to home ownership. With this offer, Credit Karma tries to improve access to credit options. This new service is in line with their initial commitment while also highlighting a first step into the mortgage industry.

- Attracting new borrowers. This launch directly relates to their recent purchase of the platform Approved. Credit Karma now enjoys an infrastructure enabling them to act as a mortgage broker. They bet on Home Buying Power to boost their prospecting efforts and assist potential borrowers.

- Taking data analytics one step further, customising financial consultancy. Since launch, every time Credit Karma diversified their range of offers, they aimed at capturing new customer data. For instance, they launched a data centralisation platform for the car industry and then unveiled a comparison service for car loans and insurance premiums.

- They rely on a similar strategy in this case, using the Approved platform to enhance their training tools for borrowers as well as their KYC.

MARKET PERSPECTIVE

- Home Buying Power has been tested since September 2018 and already attracted 1 million potential home buyers.

- Credit Karma was founded in 2007. They started out as a free tool for visualising credit scores. They commit to making it easier for their members in the US to be granted loans. This FinTech was valued at $3.5 billion in 2015.

- This former start-up further aims for diversification. They started addressing the car industry in 2017 and added a chatbot in 2018. They also expanded their service into monitoring personal data exchanged on the “Dark Web”. And they featured a comparison website for car insurance offers.

- In the end of 2018, they also bought out the British FinTech Noddle, meaning that they should eventually reach out beyond US borders after consolidating their multiple business sectors.